Introduction

In today’s fast-paced business environment, efficient management of accounts receivable is crucial for maintaining healthy cash flow and ensuring the financial stability of an organization. Accounts receivable software automates the invoicing and collections processes, enabling businesses to track outstanding invoices, manage customer payments, and optimize their cash flow cycles. This article delves into the various software solutions available for accounts receivable management, their key features, benefits, and how to choose the right one for your business.

Understanding Accounts Receivable Software

What is Accounts Receivable Software?

Accounts receivable software is a technological solution designed to manage and streamline the process of tracking money owed to a business by its customers. It automates tasks such as invoicing, payment reminders, and reconciliation, reducing manual efforts and minimizing errors. By providing real-time insights into outstanding invoices and customer payment behaviors, this software aids businesses in maintaining optimal cash flow and financial health.

Importance of Accounts Receivable Software

- Improved Cash Flow Management – Automating invoicing and payment collection accelerates the receipt of payments, reducing delays in cash flow.

- Reduced Manual Work – Automates tedious tasks like invoice generation, reminders, and reconciliation.

- Enhanced Accuracy – Minimizes human errors, ensuring accurate billing and reporting.

- Better Customer Relationships – Helps in maintaining smooth communication and transparent payment terms with customers.

- Real-time Insights – Provides dashboards and reports to track receivables, improving financial planning.

Top Accounts Receivable Software Solution

Why Emagia is the Leading Accounts Receivable Software?

When it comes to the best accounts receivable software, Emagia stands out as a premier AI-driven platform designed to transform and automate the entire order-to-cash cycle. Emagia leverages artificial intelligence, analytics, and automation to streamline accounts receivable management, ensuring faster payments, reduced risk, and optimized cash flow.

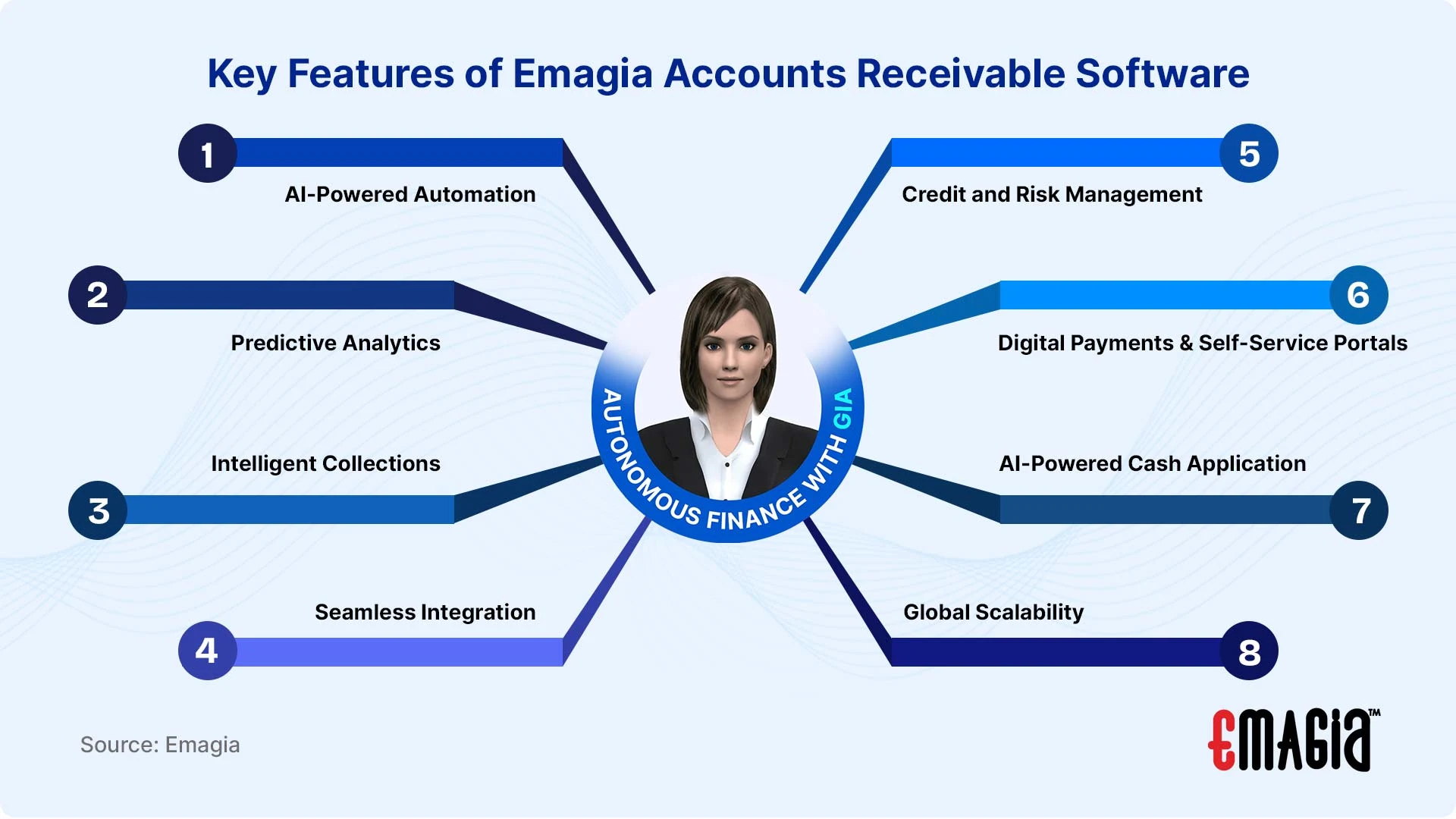

Key Features of Emagia Accounts Receivable Software

-

AI-Powered Automation

- Automates invoice generation, payment tracking, and collection processes.

- Reduces manual intervention and improves operational efficiency.

-

Predictive Analytics

- Provides insights into customer payment behavior.

- Helps forecast cash flow and identify potential risks in collections.

-

Intelligent Collections

- Uses AI-driven algorithms to prioritize overdue invoices.

- Automates payment reminders and escalations to improve collection rates.

-

Seamless Integration

- Integrates with leading ERP and accounting systems such as SAP, Oracle, and Microsoft Dynamics.

- Ensures smooth data flow and accurate financial reporting.

-

- Analyzes customer creditworthiness in real-time.

- Helps businesses mitigate financial risks associated with overdue payments.

-

Digital Payments and Self-Service Portals

- Offers a frictionless payment experience with multiple payment gateway integrations.

- Provides customers with self-service options for invoice viewing and payment processing.

-

- Matches incoming payments with invoices automatically.

- Reduces processing time and errors in payment reconciliation.

-

Global Scalability

- Supports multinational businesses with multi-currency and multi-language capabilities.

- Complies with international financial regulations and tax policies.

Choosing the Right Accounts Receivable Software

Factors to Consider When Selecting an AR Software

- Business Size and Needs – Whether a small business or an enterprise, choosing the right software depends on the complexity of AR processes.

- Integration Capabilities – Ensure compatibility with existing ERP, accounting, and CRM systems.

- Automation and AI Capabilities – Look for AI-driven analytics, smart invoicing, and automated collections.

- User-Friendliness – Software should be easy to use for both finance teams and customers.

- Security and Compliance – Check for data encryption, compliance with industry regulations (e.g., GDPR, SOX).

- Scalability – The software should be able to grow with your business.

Benefits of Using Accounts Receivable Software

- Faster Payments – Automates follow-ups and payment reminders, reducing payment delays.

- Lower DSO (Days Sales Outstanding) – Ensures quicker collections and better liquidity.

- Cost Savings – Reduces the need for manual intervention, cutting down on administrative expenses.

- Better Financial Visibility – Provides comprehensive reports and dashboards for better decision-making.

- Reduced Bad Debt – Helps identify at-risk accounts early and take preventive measures.

How Emagia Helps Businesses Transform Accounts Receivable Management

Why Choose Emagia for AR Automation?

Emagia provides an intelligent, end-to-end AR automation solution that helps businesses accelerate cash flow and improve working capital. Its AI-powered platform is designed to optimize the entire order-to-cash process, reducing inefficiencies and enhancing collections.

How Emagia Enhances AR Operations?

- Reduces Collection Efforts – Automates follow-ups and prioritizes collections based on AI insights.

- Improves Payment Predictability – Uses data-driven forecasting to predict and manage incoming cash flows.

- Enhances Customer Experience – Provides a seamless, digital payment experience with self-service capabilities.

- Minimizes Revenue Leakage – Identifies and prevents revenue loss due to late or missed payments.

Industries Benefiting from Emagia

- Manufacturing

- Healthcare

- Retail & E-commerce

- Logistics

- Financial Services

Frequently Asked Questions (FAQs)

What is the best software for accounts receivable?

Emagia is one of the best AI-powered accounts receivable software solutions, offering automation, predictive analytics, and digital payment solutions.

How does accounts receivable software work?

Accounts receivable software automates invoicing, payment tracking, and collections while providing real-time insights into outstanding invoices and cash flow.

Can AR software integrate with ERP systems?

Yes, most AR software solutions, including Emagia, integrate with ERP platforms like SAP, Oracle, and Microsoft Dynamics.

What are the key benefits of using AR software?

The main benefits include improved cash flow, reduced DSO, automated collections, enhanced financial visibility, and lower bad debt risk.

How does AI improve accounts receivable management?

AI enhances AR management by predicting payment behavior, automating follow-ups, prioritizing collections, and reducing manual efforts.

Is cloud-based AR software better than on-premise?

Cloud-based AR software offers better scalability, accessibility, and integration capabilities compared to on-premise solutions.

Conclusion

Choosing the right accounts receivable software is essential for streamlining payment collections, reducing manual work, and improving financial health. Emagia stands out as a leading AI-driven AR automation solution, helping businesses optimize cash flow and minimize payment risks. By leveraging AI, predictive analytics, and automation, Emagia transforms the way businesses manage their receivables, ensuring faster payments and better financial efficiency.

If you’re looking for a robust, intelligent, and scalable AR solution, Emagia is the best choice to take your accounts receivable management to the next level. 🚀