Order to Cash (O2C) process is a key component of the finance function. It involves receiving and fulfilling customer request for goods or services. An efficient order to cash process ensures a smooth logistical flow of operations. On the other hand, an inefficient order-to-cash process delays order processing, fulfillment, shipping, invoicing, and cash flow. While early automation solutions focused on processes that could not address the entire O2C process, newer technologies such as artificial intelligence and analytics can automate the O2C process. An intelligent O2C platform, like Emagia, can streamline the order to cash process and accelerate cash flow.

What is Order to Cash (O2C) process cycle meaning?

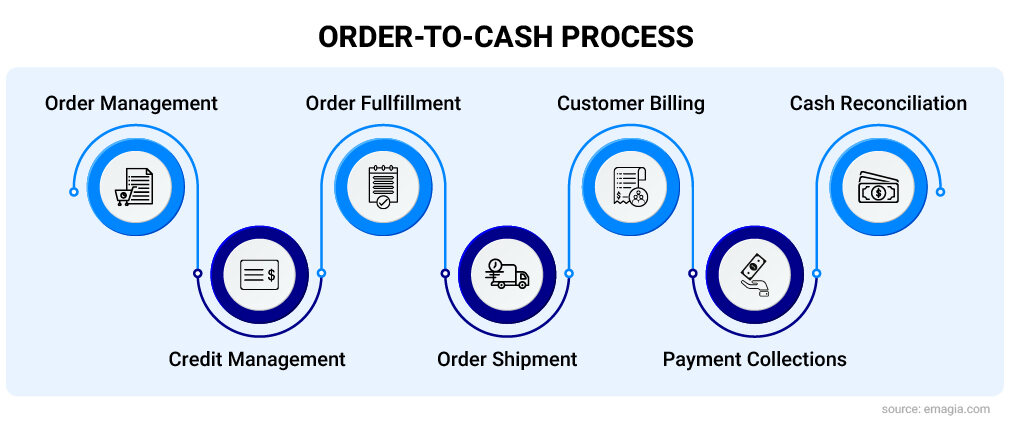

In simple words, an order to cash process is a company’s sales cycle. It involves accepting orders on credit and converting the credit sales to cash. A typical O2C cycle consists of various steps from when a customer order is placed until the business is paid. Those steps include credit, invoicing, AR portfolio management, collections, and cash application.

The O2C process is not complete when the order is received and paid for. There are many other important steps occurring in the process. Analyzing the activity data throughout the order-to-cash cycle helps optimize the order-to-cash cycle.

Shorten the O2C Cycle with Digital Invoicing & Payments. Read eBook

What are the steps in the Order to Cash process

The steps in an Order to Cash process include customer order, credit management, fulfillment, billing/invoicing, payment and collections, cash application and ledger posting. Each step in the process impacts the latter stages in the process. For example, cash application impacts collections, and collections impact credit decisions and sales order acceptance.

Credit:

The process often starts with a customer order, which initiates the credit process. The credit process involves gathering and analyzing information on the customer to determine their creditworthiness and to set the level of credit to extend to them. The data comes from the customer’s financials and other sources, including credit-rating agencies, trade groups, and internal records if the buyer is an existing customer.

Invoicing:

Upon order fulfillment, billing (consumers) or invoicing (businesses) must be done timely and accurately, through whatever delivery mechanism is necessary. These might include EDI, email, regular mail, fax or via portals. Timely invoicing is vital to timely payment. But accuracy is just as important. Invoices with incorrect or missing information slow down the payment process, creating confusion and additional work.

AR Portfolio Management:

The customer processes the invoice and pays it on time according to terms in a perfect world. Then the order-to-cash team applies the payment to the invoice or invoices, closing them out. The closed invoices relieve collections of further action and free sales to take additional orders. But the AR portfolio must be tracked and managed, with accurate and timely information provided to the collections department.

Collections:

Collections departments follow up on open invoices to encourage and obtain payment. Collectors must have accurate and timely payment information, or they will waste time collecting on invoices already paid. Collectors employ emails, phone calls, and other tools in communicating with customers to collect money owed.

Cash Application:

Cash application is the reconciliation step of matching payments to invoices. Remittance information should accompany payments to indicate which invoice or invoices the customer is paying. Check payments include attached remittance information.

But with the shift to a variety of modern non-check payment formats, remittance information comes in separately, requiring an extra step. Remittance information now must be matched to payment before AR can apply the payment to open invoices and then record it in the company’s general ledger. Cash application comes at the end of the process but feeds back essential information to collections, credit and sales.

Because errors happen, payments do not always match invoices. While some customers withhold payment until problems are corrected, many more short-pay invoices, deducting any disputed amount. Deductions necessitate a dispute resolution step. Dispute resolution must be as efficient as possible, especially given that the customer is correct in most cases. But the volume could be overwhelming, and setting tolerances for payments are an effective tool for resolving minor deductions. Deductions can provide critical intelligence pointing to upstream problems, whether in manufacturing, shipping, or invoicing. Once again, information is essential.

Transforming Order-to-Cash with Emagia Global Deployment: The ConvaTec GBS Success Story. Watch Now

Why Order to Cash (O2C) is hard

As with most processes, the challenge emerges in the details of each function. In the 21st Century, channels through which enterprises conduct business have increased, as have sources and formats of the information vital to transacting that business. Whether gathering credit information, invoicing, collecting payment, matching remittance information and applying payment, there are many sources, methods and formats involved, adding complexity.

Most large enterprises face a challenge in having multiple ERP or accounting systems, whether due to organization structure or mergers and acquisitions. That makes it very difficult, for example, to have a timely enterprise-wide view of cash position. These multiplicities are further complicated for global enterprises by multiple languages, customs, and currencies.

Within each discrete step in the O2C process across many systems, the team must locate, identify, gather, and input information in a useable format. Management, meanwhile, needs access to the data to gain an accurate understanding of the organization’s cash status and be able to make decisions. And the problem of manually doing this is twofold: manual data collection and processing is very time-consuming, and every step handled manually represents an opportunity to introduce error into the data.

Overcoming the complexity in the Order to Cash process

The complex O2C process begs automation to meet the challenges of timeliness and accuracy. Early automation solutions focused on discrete processes but could not address the entire O2C process.

Today, advances in newer technologies like artificial intelligence (AI) and analytics applied to automation make it truly possible to automate the O2C process. Together with big data management, these technologies enable the digital transformation of O2C. AI-driven O2C connects the distinct processes to provide timely, accurate intelligence through reporting and dashboard visualizations, enterprise-wide, regionally or by business unit, and individual customer.

An intelligent O2C hyperautomation platform, like Emagia, includes data lake technology to unify finance information across the enterprise and bring in necessary data from multiple external sources to one location, creating one source. The unified data lake enables the connection and communication of information between the discrete processes.

AI-enhanced robotic process automation relieves teams of manual data gathering, while cognitive data capture extracts information from multiple sources, including unformatted documents and eliminates manual data entry. In addition, machine learning increases the automation level and hones forecasting accuracy.

Digital assistants interact with and support customers in resolving questions and paying invoices, which provides a positive customer experience, crucial in a very competitive environment.

Analytics interpret massive amounts of data to provide more accurate cash flow forecasting. Descriptive, predictive and prescriptive analytics provide precise forecasting and advice to support cash management, allowing data-driven decision making.

Together these technologies exponentially increase efficiency and relieve human personnel from tedious and repetitive tasks to attend to problem-solving, customer experience and application of insights to finance management.

In the past, though finance executives understood the relationships between sales, credit, AR, collections, deductions and cash application, organizing and managing them as an efficient end-to-end process was beyond the capabilities of technology. At last, that is no longer the case. Companies mapping their O2C flow can finally successfully automate the order to cash process through comprehensive AI- and analytics-empowered solutions like Emagia.

Best Practices to Optimize the Order-to-Cash Cycle

1. Automate Order Processing

- Reduce human intervention in data entry

- Improve accuracy and efficiency

2. Implement AI-Based Credit Scoring

- Assess credit risk using predictive analytics

- Set dynamic credit limits based on real-time data

3. Optimize Invoice Management

- Adopt electronic invoicing (e-invoicing)

- Standardize invoice formats for better compliance

4. Improve Payment Collection Strategies

- Offer multiple payment options

- Send automated payment reminders

5. Enhance Dispute Resolution

- Implement AI-driven dispute tracking

- Resolve claims swiftly to maintain customer relationships

6. Utilize Data Analytics for Decision-Making

- Monitor KPIs such as DSO (Days Sales Outstanding)

- Use machine learning for trend analysis

How Emagia Transforms Order-to-Cash with AI-Powered Automation

Emagia, a leader in AI-driven order-to-cash solutions, revolutionizes the O2C process with intelligent automation, predictive analytics, and machine learning algorithms.

Features of Emagia’s O2C Solution:

- AI-Based Credit Management: Automates credit scoring and risk assessment

- Digital Order Processing: Streamlines order validation and fulfillment

- Automated Invoicing: Generates accurate invoices and tracks outstanding dues

- Smart Payment Processing: Integrates multiple payment gateways for seamless transactions

- Predictive Cash Flow Analytics: Uses AI to forecast revenue trends

- Automated Dispute Resolution: Identifies and resolves disputes with AI-powered insights

By implementing Emagia’s AI-driven O2C automation, businesses can reduce DSO, improve cash flow, and enhance customer satisfaction.

Frequently Asked Questions (FAQs)

1. What is the Order-to-Cash cycle?

The Order-to-Cash cycle refers to the end-to-end process businesses use to receive orders, fulfill them, generate invoices, collect payments, and reconcile accounts.

2. Why is the Order-to-Cash process important?

A streamlined O2C process ensures faster revenue realization, improved cash flow, accurate invoicing, and better customer satisfaction.

3. What are the key steps in the O2C process?

The key steps include order management, credit assessment, order fulfillment, invoicing, accounts receivable, payment collection, dispute management, and reporting.

4. How can businesses optimize the O2C cycle?

Businesses can optimize O2C by implementing automation, AI-based credit scoring, electronic invoicing, and predictive analytics to minimize errors and improve efficiency.

5. How does AI improve the Order-to-Cash process?

AI enhances O2C by automating credit risk assessments, predicting cash flow trends, streamlining invoicing, and resolving disputes proactively.

Conclusion

The Order-to-Cash process is the backbone of revenue management for any business. By embracing AI-powered automation and best practices, organizations can significantly improve their O2C efficiency, cash flow, and customer relationships. Emagia’s O2C automation solutions offer a cutting-edge approach to optimizing the entire cycle, enabling businesses to stay ahead in the competitive market.