In today’s financial landscape, managing outstanding debts efficiently is crucial for businesses aiming to maintain healthy cash flows. Debt collection software has emerged as a vital tool in automating and streamlining the debt recovery process. This comprehensive guide delves into the intricacies of debt collection software, exploring its features, benefits, implementation strategies, and more.

Introduction to Debt Collection Software

Definition and Purpose

Debt collection software is a technological solution designed to automate and manage the process of recovering overdue payments from individuals or businesses. It integrates with existing financial systems to streamline workflows, enhance communication with debtors, and ensure compliance with regulatory standards.

Evolution of Debt Collection Practices

Traditionally, debt collection involved manual processes, including phone calls, letters, and in-person visits. With advancements in technology, these practices have evolved into automated systems that increase efficiency and accuracy, reducing the reliance on manual labor and minimizing human error.

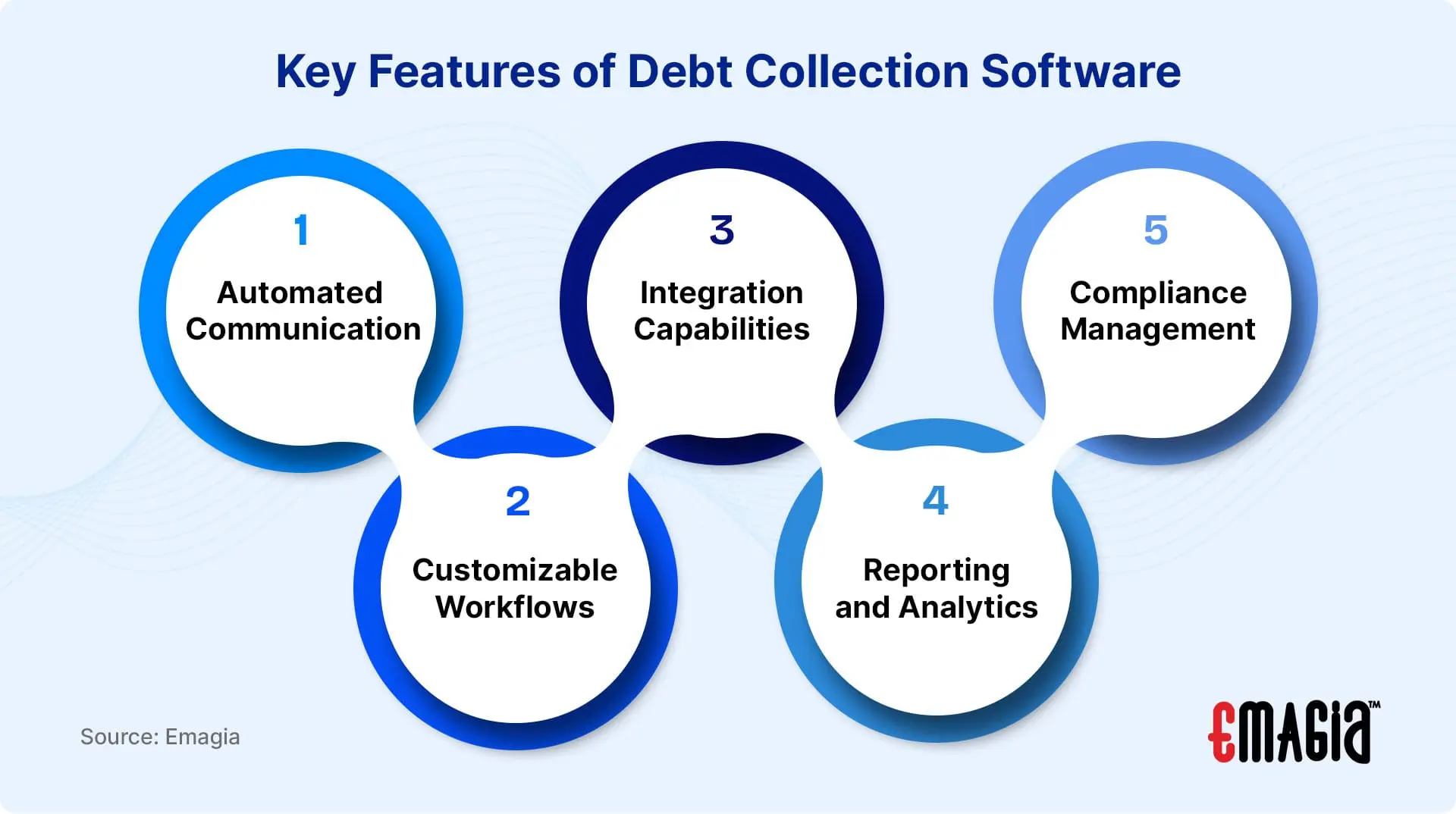

Key Features of Debt Collection Software

Automated Communication

Modern debt collection software facilitates automated communication through various channels such as emails, SMS, and phone calls, ensuring timely reminders and follow-ups with debtors.

Customizable Workflows

The software allows for the creation of customizable workflows tailored to specific business needs, enabling organizations to define processes that align with their collection strategies.

Integration Capabilities

Seamless integration with Customer Relationship Management (CRM) and accounting systems ensures that all financial data is centralized, providing a holistic view of debtor information and payment histories.

Reporting and Analytics

Robust reporting and analytics tools offer insights into key performance indicators (KPIs), helping businesses monitor success rates, identify bottlenecks, and optimize collection strategies.

Compliance Management

Ensuring adherence to laws such as the Fair Debt Collection Practices Act (FDCPA) and the General Data Protection Regulation (GDPR) is crucial. Debt collection software includes features that help maintain compliance through audit trails and regulatory checks.

Benefits of Implementing Debt Collection Software

Increased Efficiency

Automation reduces the time and effort required to manage collections, allowing staff to focus on more strategic tasks and improving overall productivity.

Improved Accuracy

By maintaining accurate and up-to-date records of debtor information, payment histories, and communication logs, the software minimizes errors and discrepancies, leading to higher recovery rates.

Enhanced Compliance

Built-in compliance features ensure that all collection activities adhere to relevant laws and regulations, reducing the risk of legal issues and fines.

Better Debtor Relationships

Automated yet personalized communication helps maintain positive relationships with debtors, increasing the likelihood of successful collections and future business opportunities.

Cost Savings

Streamlining the collection process leads to significant cost savings by reducing manual labor, minimizing errors, and increasing the speed of recovery.

Types of Debt Collection Software

On-Premise Solutions

Installed locally on a company’s servers, on-premise solutions offer greater control over data and customization but require significant upfront investment and ongoing maintenance.

Cloud-Based Solutions

Hosted on the vendor’s servers and accessed via the internet, cloud-based solutions provide scalability, regular updates, and lower initial costs, making them suitable for businesses of all sizes.

Industry-Specific Solutions

Tailored to meet the unique needs of specific industries, these solutions offer specialized features and compliance tools relevant to particular sectors.

Selecting the Right Debt Collection Software

Assessing Business Needs

Identify specific requirements such as the volume of accounts, integration needs, and compliance considerations to ensure the chosen software aligns with organizational goals.

Evaluating Features and Functionality

Compare features across different software options, focusing on those that offer the most value and align with your collection strategies.

Considering Scalability and Flexibility

Choose a solution that can grow with your business and adapt to changing needs, ensuring long-term viability.

Reviewing Vendor Support and Reputation

Research vendor reliability, customer support quality, and user reviews to make an informed decision.

Budget Considerations

Balance the cost of the software with the features offered, ensuring it provides a good return on investment.

Implementation Strategies for Debt Collection Software

Planning and Preparation

Develop a detailed implementation plan outlining timelines, responsibilities, and objectives to ensure a smooth transition.

Data Migration

Carefully plan the transfer of existing data into the new system, ensuring accuracy and completeness to maintain continuity.

Training and Support

Provide comprehensive training for staff to ensure they are proficient in using the new system and understand its capabilities.

Testing and Quality Assurance

Conduct thorough testing to identify and resolve any issues before full deployment, ensuring the system operates as intended.

Go-Live and Monitoring

Launch the system and monitor its performance closely, making adjustments as needed to optimize functionality.

Challenges and Solutions in Debt Collection Software Implementation

Data Security Concerns

Implement robust security measures, including encryption and access controls, to protect sensitive debtor information.

Integration Issues

Work closely with vendors to ensure seamless integration with existing systems, addressing any compatibility issues promptly.

User Adoption

Encourage user adoption through effective training programs and by highlighting the benefits of the new system to staff.

Regulatory Compliance

Stay updated on relevant laws and regulations, configuring the software to ensure ongoing compliance.

How Emagia Revolutionizes Debt Collection

Streamlining Collections with AI-Powered Automation

Emagia leverages cutting-edge artificial intelligence to automate the debt collection process, reducing manual intervention and increasing efficiency. Its intelligent automation capabilities help organizations prioritize accounts, schedule follow-ups, and send personalized reminders, ensuring no overdue payment is overlooked.

Advanced Analytics for Data-Driven Decisions

Emagia’s robust analytics platform provides real-time insights into collection performance, enabling businesses to make informed decisions. It tracks key metrics such as Days Sales Outstanding (DSO), recovery rates, and debtor behavior, helping organizations optimize their strategies for maximum recovery.

Seamless Integration and Customization

Emagia seamlessly integrates with popular ERP and CRM systems, ensuring a unified platform for financial operations. Its customizable workflows allow businesses to tailor the debt collection process according to their specific needs, enhancing operational flexibility.

Compliance and Security

Maintaining compliance with industry regulations is crucial for debt collection. Emagia includes built-in compliance features that align with global standards such as FDCPA, GDPR, and other regional laws, safeguarding organizations against legal complications.

Enhanced Customer Experience

Emagia focuses on maintaining positive customer relationships by providing a debtor portal for easy payment options and transparent communication. Its AI-driven conversational agents offer round-the-clock assistance, ensuring a smooth and respectful debt recovery experience.

Cost Efficiency and ROI

By automating labor-intensive tasks and optimizing resource allocation, Emagia significantly reduces operational costs. Its advanced predictive analytics minimize bad debt write-offs, resulting in a higher return on investment.

Why Choose Emagia?

Emagia stands out as a leading debt collection software solution due to its comprehensive features, scalability, and focus on customer-centric collections. Its innovative approach combines automation, analytics, and compliance, making it the go-to choice for businesses looking to streamline their accounts receivable processes.

Frequently Asked Questions (FAQs)

What is debt collection software?

Debt collection software is a tool designed to automate and streamline the process of recovering overdue payments from customers, improving efficiency and compliance.

How does debt collection software work?

It automates communication, manages workflows, tracks payment histories, and generates reports, helping businesses recover debts faster and more efficiently.

Why is debt collection software important?

It reduces manual labor, enhances accuracy, ensures compliance, and improves cash flow by accelerating the debt recovery process.

Can debt collection software integrate with other systems?

Yes, most debt collection software solutions integrate with CRM, ERP, and accounting systems for centralized data management.

Is debt collection software secure?

Reputable software providers implement advanced security measures, including data encryption and access controls, to protect sensitive information.

What features should I look for in debt collection software?

Key features include automated communication, customizable workflows, reporting and analytics, compliance management, and integration capabilities.

How much does debt collection software cost?

Pricing varies depending on features, deployment type (cloud or on-premise), and vendor. It typically ranges from monthly subscriptions to one-time licenses.

Can debt collection software help with compliance?

Yes, it ensures adherence to legal requirements such as FDCPA and GDPR, minimizing the risk of legal issues.

What are the benefits of using Emagia for debt collection?

Emagia offers AI-powered automation, advanced analytics, seamless integration, and enhanced customer experience, all while ensuring compliance and data security.

How do I get started with Emagia debt collection software?

You can visit Emagia’s website, schedule a demo, and speak to their experts to explore tailored solutions for your business needs.

Conclusion

Debt collection software is a vital tool for modern businesses aiming to streamline their accounts receivable processes and maximize recovery rates. With its advanced automation, analytics, and compliance features, debt collection software significantly enhances operational efficiency, accuracy, and customer relationships.

Emagia stands out as a leader in this domain, offering a comprehensive suite of features designed to meet the needs of businesses of all sizes. By choosing Emagia, organizations can revolutionize their debt collection strategies, ensuring cost efficiency, compliance, and an improved bottom line.

Whether you’re a small business or a large enterprise, investing in the right debt collection software can make a substantial difference. Explore Emagia’s innovative solutions today and take the first step towards smarter, more efficient debt management.