The global economic landscape of the previous year was fraught with tension, stemming from the collapse of Silicon Valley Bank (SVB), a bank run, and the Fed’s decision to maintain interest rates at historic highs to curb inflation. These events underscored the paramount importance of liquidity management in the corporate sphere, prompting an intensified focus on navigating financial uncertainties.

The corporate treasury function confronts the daunting task of managing accounts receivable risks, cash flows, and navigating forex and interest rate volatility, particularly in times of uncertainty. Consequently, businesses are embracing innovative technologies in treasury management at an unprecedented pace, facilitating strategic financial analysis with foresight. Treasury managers grappling with liquidity and risk management challenges recognize that integrating AI into corporate liquidity management is not merely advantageous but imperative for ensuring financial stability and resilience.

Let us delve into the intersection of technology and treasury management processes, illuminating how these innovations, notably the adoption of AI, are pivotal in mitigating risks and managing liquidity in the day-to-day operations of corporate finance.

AI in Liquidity Management and Risk Mitigation

Treasury management faces the added challenge of weathering tumultuous economic conditions, from global economic turmoil to recent disruptions like the SVB collapse.

Artificial Intelligence equips finance professionals with strategic tools to navigate complex financial landscapes. This technology can identify risks during customer onboarding, continually monitor customer default risks, manage accounts receivable efficiently, enhance cash flows, optimize liquidity, and refine risk management strategies. Such capabilities empower treasury managers to proactively address financial challenges, including liquidity concerns.

Deloitte’s first-quarter 2023 CFO Signals survey revealed that 64% of CFOs cited inadequate technologies or systems, while 62% highlighted immature capabilities as barriers to translating data into actionable insights. Organizations leveraging AI and data analytics for informed decision-making gain a competitive edge, leaving those lagging struggling to react to challenges rather than proactively respond. AI’s real-time data processing and effective dissemination enhance treasury management effectiveness, providing organizations with a strategic advantage.

The Potential of AI for Enterprise Treasury Managers

The prowess of AI, exemplified by tools like ChatGPT and Emagia’s own GiaGPT, is increasingly evident across various domains, including financial and treasury management. AI’s adaptable capabilities in financial analysis, credit risk management, receivables management, task automation, and accurate analysis of large datasets enhance reporting, analysis, precision, and consistency in treasury management and risk mitigation.

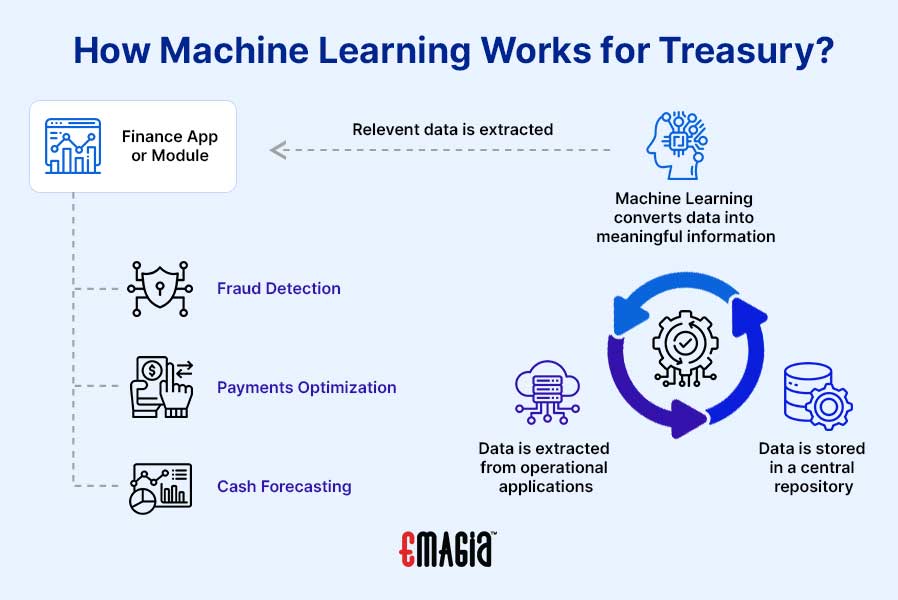

Machine learning (ML) empowers AI to glean insights from historical data, enabling businesses to generate accurate cash flow forecasts automatically. Its capacity to adapt to organizational changes ensures precise forecasting, vital for informed decision-making. AI-powered tools assist financial professionals, particularly treasury managers, in navigating uncertainties and customer payment defaults, facilitating informed decisions around order management and credit approval.

Economic Viability of AI in Treasury Management

The economic viability of AI adoption in treasury management assumes significance, especially during periods of economic volatility and uncertainty. While initial capital expenditure associated with AI adoption may pose a hurdle, organizations anticipate strategic advantages such as cost savings. The accelerated adoption of AI should drive down implementation costs, rendering AI solutions more accessible, even to smaller entities. Moreover, AI tools are poised to deliver both short-term gains and long-term stability, offering a strategic advantage in risk mitigation and liquidity management.

Addressing Bias in AI in Risk and Liquidity Management

Treasury and liquidity management are among the top organizational and financial priorities, necessitating precise, and unbiased decision-making. Unintentional bias in AI algorithms can jeopardize information accuracy, leading to liquidity risks, particularly in uncertain economic environments. To mitigate this risk, AI systems must be devoid of bias, ensuring that decisions are based on precise, unbiased data.

While building unbiased AI algorithms presents an initial challenge, continuous monitoring and refinement are crucial. AI algorithms must evolve alongside economic landscapes, prioritizing transparency, and accountability to proactively identify and address biases. Ensuring unbiased AI systems is essential to empower treasury managers with accurate insights for informed decision-making.

The Outlook for AI Adoption in Corporate Treasury

AI’s evolution holds immense potential for enhancing risk management and liquidity management in finance, particularly during economic uncertainties. As businesses contemplate AI adoption for tasks traditionally reliant on human judgment, unbiased AI algorithms must provide comprehensive information to facilitate precise decision-making, ensuring financial sustainability.

AI’s role in finance, including treasury management, transcends task automation, reshaping organizational decision-making strategies. By overcoming human limitations and traditional methodologies, AI offers accurate insights and predictions. However, the pervasive adoption of AI necessitates cautious management to balance its benefits and risks effectively. Amid uncertainty and potential risks, organizations must embrace innovative approaches for efficiency and adaptability. AI’s integration into existing business processes offers undeniable advantages. The outlook for AI adoption in finance, including treasury management, hinges on its ability to augment human expertise, improve decision-making, and adapt to evolving environments.

The Role of Generative Models in Liquidity Management

GenAI models present a new frontier in treasury management by leveraging diverse data sources such as digital assets, internet data, videos, photos, and emails. This enables businesses to enhance real-time decision-making, predict and navigate financial uncertainties with greater accuracy, and make proactive decisions on customer orders, credits, and delayed receivables.

In dynamic economic and market environments characterized by rapid changes and unforeseen challenges, generative AI models enrich AI systems with diverse data types, transforming the treasury manager’s decision-making paradigm. Amid uncertainty, AI systems capable of analyzing a wide range of data sources empower businesses to proactively respond to financial risks, enhancing predictive capabilities and strategic decision-making.

FAQs

What is Treasury Risk Management (TRM)?

Treasury Risk Management involves planning for unexpected cash flows and uncertain conditions to mitigate and avoid the impact of changing financial environments on a company’s cash flow objectives.

What is Liquidity Management?

Liquidity management is the proactive process of ensuring an organization has sufficient cash on hand to meet its financial obligations when they become due, directly impacting working capital and cash flow.

What is Artificial Intelligence (AI) Bias?

AI bias refers to AI systems generating biased results mirroring and perpetuating human biases, potentially leading to harmful effects. This bias stems from skewed training data or AI algorithms reflecting human biases.