Introduction

In today’s fast-paced business environment, efficient management of accounts receivable (AR) is crucial for maintaining healthy cash flow and ensuring financial stability. Manual AR processes are often time-consuming and prone to errors, leading to delayed payments and strained customer relationships. To address these challenges, many organizations are turning to Accounts Receivable Automation Solutions. These technologies streamline AR processes, reduce manual intervention, and enhance overall efficiency.

Understanding Accounts Receivable Automation

What is Accounts Receivable Automation?

Accounts Receivable Automation involves the use of technology to automate the various tasks associated with managing receivables. This includes automating invoice generation, payment reminders, cash application, and reconciliation processes. By implementing AR automation, businesses can minimize errors, accelerate payment cycles, and improve cash flow management.

Benefits of Implementing Accounts Receivable Automation Solutions

- Reduced Errors and Improved Accuracy: Automation minimizes human errors in invoicing and payment processing, ensuring accurate financial records.

- Increased Efficiency: Automated workflows streamline AR tasks, freeing up staff to focus on strategic activities.

- Enhanced Cash Flow: Faster invoicing and payment processing lead to quicker cash inflows.

- Improved Customer Relationships: Timely and accurate billing enhances customer satisfaction and trust.

- Better Reporting and Analytics: Automation solutions provide real-time insights into AR metrics, aiding in informed decision-making.

Key Features of Top Accounts Receivable Automation Solutions

- Automated Invoice Generation and Distribution: Creating and sending invoices automatically to customers.

- Payment Reminder Automation: Sending automated reminders to customers for upcoming or overdue payments.

- Cash Application Automation: Automatically matching incoming payments to outstanding invoices.

- Integration with ERP and Accounting Systems: Seamlessly connecting with existing financial systems for data consistency.

- Customer Self-Service Portals: Allowing customers to view invoices, make payments, and manage their accounts online.

- Advanced Reporting and Analytics: Providing insights into AR performance, aging reports, and cash flow forecasts.

Top Accounts Receivable Automation Solution: Emagia

Emagia: Revolutionizing Accounts Receivable Automation

Emagia is a leading Accounts Receivable (AR) automation solution, designed to help businesses streamline their receivables management processes. With a comprehensive suite of tools powered by artificial intelligence (AI), Emagia simplifies the entire AR cycle, from invoicing to cash application, collections, and reporting.

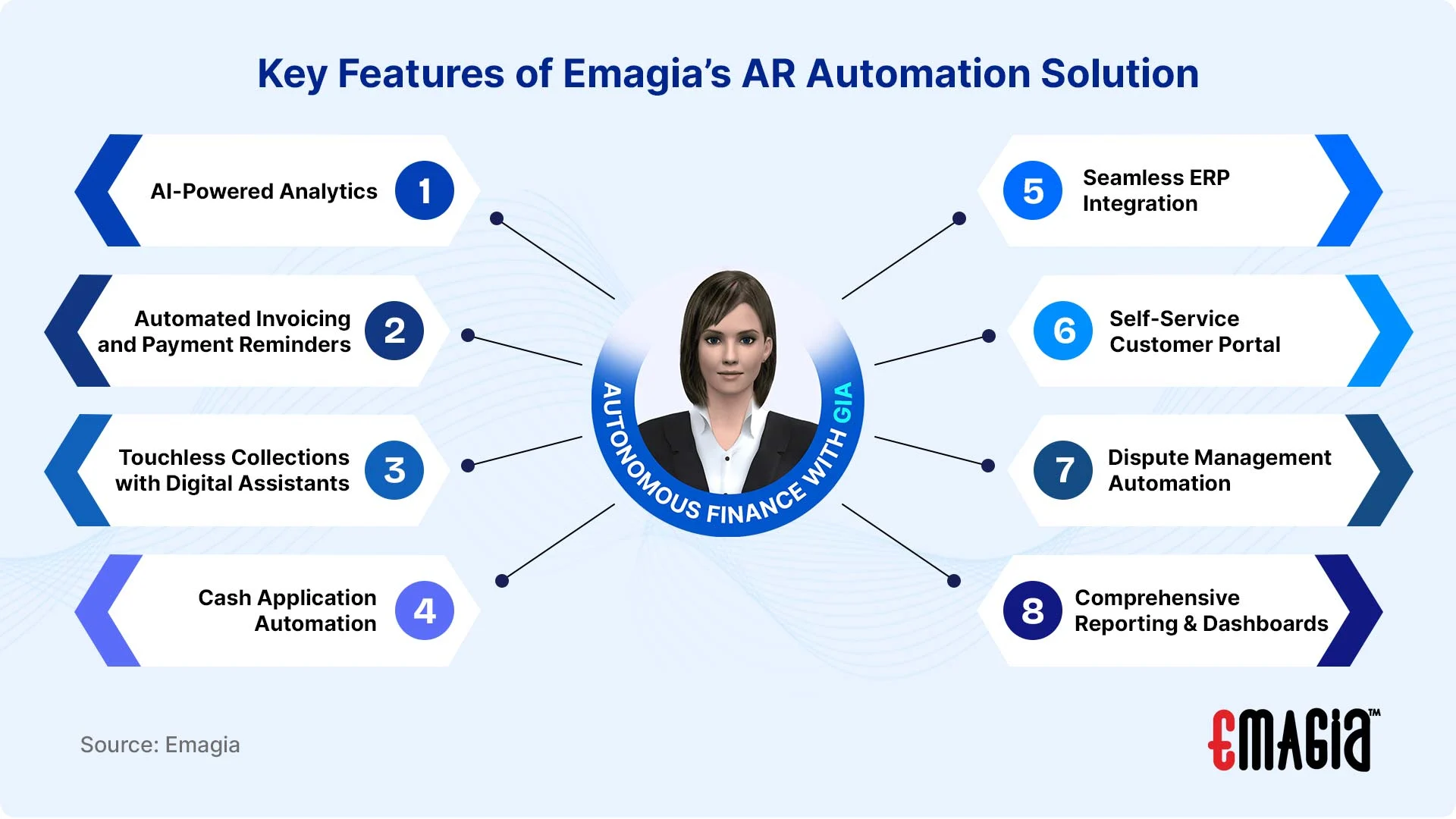

Key Features of Emagia’s AR Automation Solution

1. AI-Powered Analytics

Emagia leverages AI to provide real-time insights into key AR metrics, such as Days Sales Outstanding (DSO), collections performance, and cash flow forecasting. Its powerful analytics dashboard allows AR teams to monitor and track performance across multiple accounts, making data-driven decisions easier and faster.

2. Automated Invoicing and Payment Reminders

One of the standout features of Emagia is its automated invoicing and payment reminder functionality. Invoices are generated and sent automatically based on pre-defined schedules, ensuring accuracy and reducing manual effort. Additionally, Emagia sends automated payment reminders to customers, helping businesses stay on top of overdue accounts and accelerating the payment cycle.

3. Touchless Collections with Digital Assistants

Emagia’s solution offers digital assistants that help manage collections in a touchless manner. These AI-powered assistants automatically follow up with customers regarding outstanding invoices, prioritize accounts based on risk, and even manage dispute resolutions. This reduces the workload for AR professionals and helps boost collection efficiency.

4. Cash Application Automation

Emagia’s AI-driven cash application feature automatically matches incoming payments to outstanding invoices, reducing manual effort and errors. It speeds up the cash application process, ensuring that payments are posted quickly, and minimizing delays in the accounting cycle.

5. Seamless ERP Integration

Emagia seamlessly integrates with leading ERP systems like SAP, Oracle, and Microsoft Dynamics. This integration ensures that financial data flows seamlessly between the AR system and other accounting tools, eliminating the need for manual data entry and enhancing overall efficiency.

6. Self-Service Customer Portal

Emagia provides a self-service customer portal that allows clients to view invoices, check payment statuses, and make payments online. This not only improves customer satisfaction by offering a more convenient payment experience but also reduces the burden on AR teams by decreasing the number of inbound inquiries.

7. Dispute Management Automation

Emagia automates the dispute management process by categorizing disputes, routing them to the appropriate teams, and providing necessary documentation for faster resolution. This helps reduce the time spent on dispute management and ensures customers’ concerns are addressed quickly and effectively.

8. Comprehensive Reporting and Dashboards

Emagia offers customizable dashboards that provide key insights into AR performance. Users can generate reports on collections, payments, aging accounts, and more. These reports are crucial for understanding AR trends, identifying bottlenecks, and making informed decisions to improve cash flow.

Why Choose Emagia for AR Automation?

– Improved Cash Flow

By automating key AR processes, Emagia accelerates the invoicing and payment cycle, reducing Days Sales Outstanding (DSO) and improving cash flow management.

– Enhanced Operational Efficiency

Emagia automates repetitive tasks like invoicing, collections, and payment reminders, freeing up valuable time for your AR team to focus on higher-value activities.

– AI-Driven Insights

Emagia’s AI-powered tools provide advanced analytics that helps businesses make data-driven decisions to optimize the AR cycle, improve cash flow forecasting, and reduce collection times.

– Seamless Integration

Emagia integrates effortlessly with your existing ERP and accounting systems, ensuring data consistency across platforms and enhancing the overall AR workflow.

– Scalability

Emagia is designed to grow with your business. Whether you’re a small business or a large enterprise, Emagia’s AR automation solution can scale to meet your evolving needs.

How Emagia Enhances Accounts Receivable Automation

Emagia’s AI-powered Accounts Receivable Automation Software offers a comprehensive solution to streamline AR processes. Key features include:

- AI-Powered Analytics: Provides sophisticated visualizations and smart analytics, delivering key performance metrics across the entire AR cycle.

- Digital Assistants: Enhances touchless collections and automates routine tasks, allowing AR professionals to focus on higher-value activities.

- Automated Cash Application: Matches payments with invoices using AI-driven automation, reducing manual effort and errors.

- Seamless ERP Integration: Connects effortlessly with major ERP systems like SAP, Oracle, and Microsoft Dynamics for a unified AR workflow.

- Advanced Collections Management: Automates follow-ups, prioritizes overdue accounts, and provides real-time visibility into collections performance.

- Self-Service Customer Portal: Enhances customer experience by providing a portal for invoice tracking, payment processing, and dispute resolution.

Emagia’s comprehensive solution ensures faster payments, reduced DSO, and improved working capital efficiency, making it a top choice for enterprises looking to modernize their accounts receivable processes.

Frequently Asked Questions (FAQs)

What is Accounts Receivable Automation Software?

Accounts Receivable Automation Software is a digital solution that automates invoicing, payment processing, collections management, and cash application to improve efficiency and accuracy in managing receivables.

How Does Accounts Receivable Automation Improve Cash Flow?

By automating payment reminders, accelerating invoice processing, and reducing delays in collections, AR automation ensures faster payments and better cash flow management.

What are the Key Features of Accounts Receivable Automation Solutions?

Key features include automated invoicing, payment processing, collections tracking, cash application, ERP integration, AI-driven analytics, and self-service customer portals.

Which Industries Benefit the Most from AR Automation?

Industries with high transaction volumes, such as finance, healthcare, manufacturing, retail, and logistics, benefit significantly from AR automation solutions.

How Do AR Automation Solutions Integrate with Existing Accounting Systems?

Most AR automation platforms integrate with popular ERPs like SAP, Oracle, QuickBooks, Microsoft Dynamics, and NetSuite to ensure seamless data synchronization.

Can Small Businesses Use Accounts Receivable Automation?

Yes, many AR automation solutions cater to small businesses with scalable features like automated invoicing, payment tracking, and basic collections management.

How Do AI and Machine Learning Enhance AR Automation?

AI and machine learning improve AR automation by predicting payment behavior, optimizing collection strategies, and reducing manual intervention in cash application processes.

What Security Features Should AR Automation Solutions Have?

Robust security features include data encryption, user access controls, audit logs, compliance with financial regulations, and fraud detection mechanisms.

How Do I Choose the Best AR Automation Solution for My Business?

Consider factors like scalability, integration capabilities, pricing, customer support, AI-driven features, and user reviews to select the best AR automation solution for your needs.

Conclusion

Accounts Receivable Automation Solutions have transformed the way businesses manage their receivables, improving efficiency, reducing errors, and accelerating cash flow. From AI-powered platforms like Emagia and HighRadius to small business-friendly solutions like QuickBooks and FreshBooks, there are numerous options to meet various business needs.

Investing in the right AR automation software can drive long-term financial health and operational efficiency, ensuring your business stays ahead in a competitive marketplace.