In today’s fast-paced financial services industry, operational efficiency and data accuracy are essential for staying competitive. Traditional methods of manual data entry and document processing can be slow, prone to errors, and costly. To overcome these challenges, many organizations are turning to Intelligent Document Processing (IDP) AI as a transformative solution that not only streamlines operations but also delivers measurable cost savings and improves accuracy across key processes.

How IDP AI Works

Intelligent Document Processing (IDP) AI leverages cutting-edge technologies like Optical Character Recognition (OCR) and Natural Language Processing (NLP) to automatically extract structured data from a wide range of financial documents, such as invoices, contracts, loan agreements, and bank statements. By automating these tasks, IDP eliminates the need for manual data entry, dramatically reducing human error and ensuring a higher level of data precision.

Key Benefits of IDP AI for Financial Services

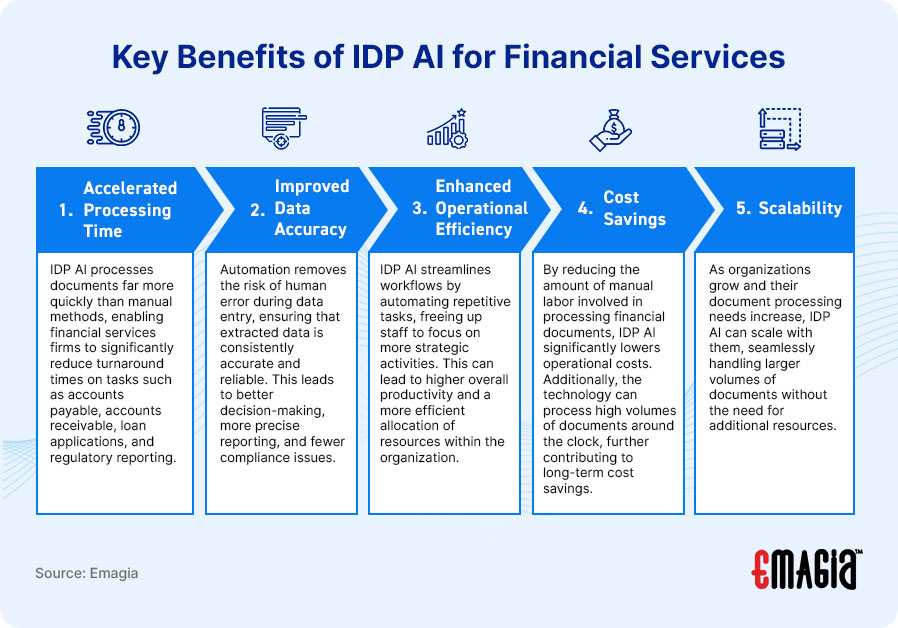

IDP AI offers a wide range of benefits for financial services firms that are looking to optimize their operations:

- Accelerated Processing Time: IDP AI processes documents far more quickly than manual methods, enabling financial services firms to significantly reduce turnaround times on tasks such as accounts payable, accounts receivable, loan applications, and regulatory reporting.

- Improved Data Accuracy: Automation removes the risk of human error during data entry, ensuring that extracted data is consistently accurate and reliable. This leads to better decision-making, more precise reporting, and fewer compliance issues.

- Enhanced Operational Efficiency: IDP AI streamlines workflows by automating repetitive tasks, freeing up staff to focus on more strategic activities. This can lead to higher overall productivity and a more efficient allocation of resources within the organization.

- Cost Savings: By reducing the amount of manual labor involved in processing financial documents, IDP AI significantly lowers operational costs. Additionally, the technology can process high volumes of documents around the clock, further contributing to long-term cost savings.

- Scalability: As organizations grow and their document processing needs increase, IDP AI can scale with them, seamlessly handling larger volumes of documents without the need for additional resources.

Industry Insights and Expert Opinions

Experts agree that IDP AI is a game-changer for the financial services industry, offering clear advantages in terms of efficiency, accuracy, and cost reduction:

- Everest Group: “The adoption of IDP AI can lead to substantial improvements in data accuracy and operational efficiency, making it a key driver of ROI for financial services firms.”

- IDC: “The Intelligent Document Processing market is forecast to grow at a compound annual growth rate (CAGR) of 21.7% from 2021 to 2031, reaching $7.4 billion, driven by increasing demand for automation in document-heavy industries such as finance.”

- Gartner: “IDP AI should be a strategic priority for organizations seeking to improve operational efficiency, reduce costs, and better manage compliance.”

- KPMG: “IDP has the potential to give financial services firms a competitive edge by improving customer experience, reducing operational risks, and ensuring more accurate, timely data.”

- Forrester: “By automating manual processes and ensuring data accuracy, IDP solutions offer significant ROI, particularly in document-intensive industries like financial services.”

Quantifying the Benefits

The specific return on investment (ROI) that an organization can achieve with IDP AI will depend on various factors, such as the size and complexity of its operations, the volume of documents processed, and the effectiveness of current systems. However, studies have shown that financial services firms implementing IDP AI solutions often experience substantial improvements. For example, IDP AI can reduce document processing times by as much as 80%, while increasing data accuracy rates by up to 95%. These improvements not only enhance operational performance but also lead to cost reductions and increased customer satisfaction by speeding up critical financial processes.

In summary, Intelligent Document Processing AI is quickly becoming a cornerstone of digital transformation strategies in the financial services industry. By automating document-centric processes, organizations can achieve unprecedented levels of efficiency, accuracy, and cost-effectiveness, positioning themselves for long-term success in a highly competitive marketplace.

Cutting-Edge Solution for Financial Document Processing

Leveraging AI for financial document data capture, such as the capabilities offered by GiaDocs AI from Emagia, delivers considerable advantages, including increased efficiency, improved accuracy, reduced operational costs, compliance support, and scalability. By integrating AI, finance teams can transform key processes like accounts receivable, accounts payable, invoicing, and other critical functions, ensuring they remain competitive in a rapidly changing marketplace. For instance, a leading global manufacturing company adopted GiaDocs AI to automate and optimize invoice processing, achieving over 85% straight-through processing for invoices from suppliers in over 50 countries, with multiple currencies and languages. GiaDocs AI eliminated manual intervention, minimized errors, and elevated the company’s financial operations to top-tier performance.

Intelligent Document Processing AI is a game-changer for financial services firms. By automating manual processes, improving accuracy, and reducing costs, IDP AI can help organizations achieve significant operational efficiencies and gain a competitive advantage. If you’re looking to unlock the potential of your financial operations, consider implementing IDP AI today.

For more information on how GiaDocs AI can help you leverage the power of IDP, Visit our website.