In today’s fast-paced business environment, managing accounts receivable efficiently is crucial for maintaining healthy cash flow and ensuring financial stability. An Integrated Receivables Automation Solution offers a comprehensive approach to streamline and optimize the entire receivables process. This article delves deep into the concept, benefits, components, implementation strategies, and the transformative impact of integrated receivables automation on businesses.

Understanding Integrated Receivables Automation Solutions

An Integrated Receivables Automation Solution is a technology-driven platform that consolidates various accounts receivable (AR) processes into a unified system. By leveraging automation, analytics, and artificial intelligence (AI), it enhances efficiency, accuracy, and visibility across the receivables lifecycle. This integration encompasses functions such as credit management, invoicing, collections, deductions, and cash application.

Key Components of Integrated Receivables Automation Solutions

- Credit Management Automation

- Automated Credit Assessments: Utilizing AI to evaluate customer creditworthiness by integrating with credit bureaus and internal data sources.

- Dynamic Credit Limits: Adjusting credit limits in real-time based on customer payment behavior and financial health.

- Invoicing Automation

- Electronic Invoice Generation: Creating and distributing invoices electronically to reduce manual effort and errors.

- Invoice Tracking: Monitoring invoice delivery and receipt status to ensure timely payments.

- Collections Management

- Automated Dunning Processes: Implementing systematic follow-ups for overdue invoices through automated reminders.

- Prioritization of Collection Efforts: Using analytics to focus on high-risk accounts and optimize collection strategies.

- Deductions and Dispute Management

- Automated Deduction Coding: Classifying and resolving deductions efficiently to minimize revenue leakage.

- Dispute Resolution Workflows: Streamlining the process to handle customer disputes promptly and effectively.

- Cash Application Automation

- Payment Matching: Automatically matching incoming payments with open invoices to accelerate cash application.

- Remittance Processing: Handling various remittance formats to ensure accurate and timely cash posting.

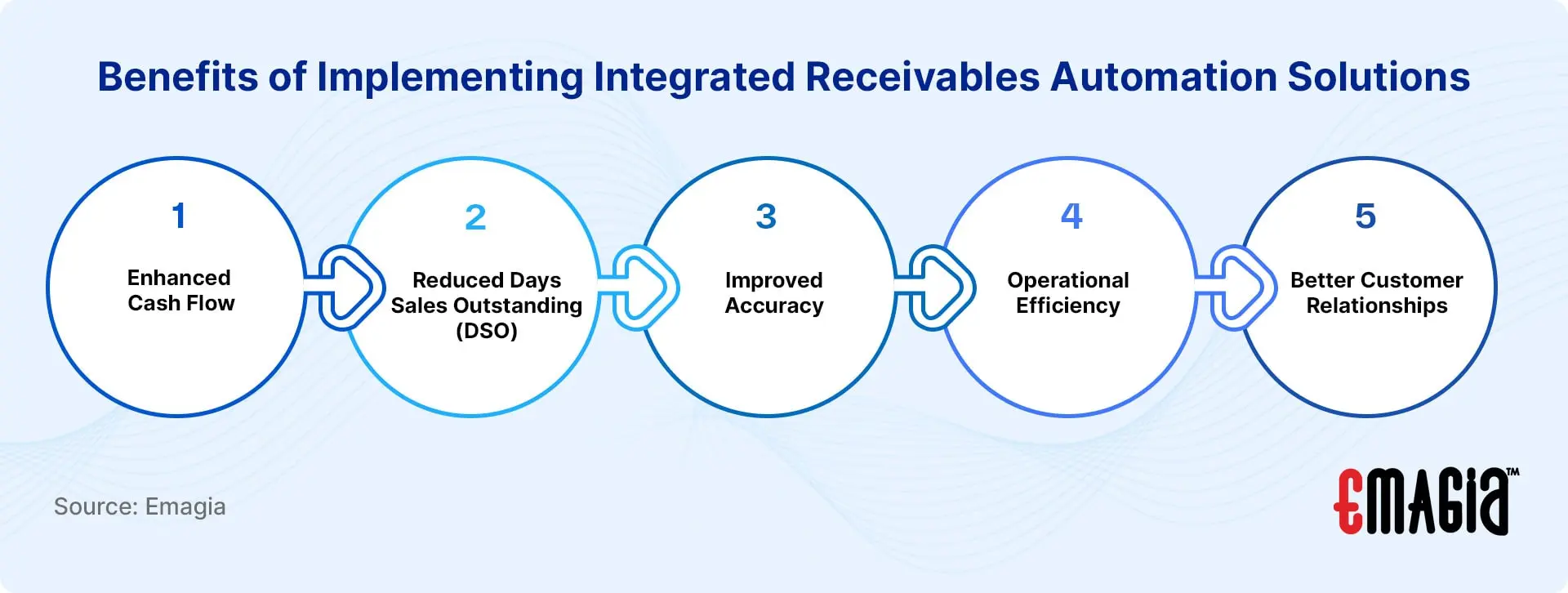

Benefits of Implementing Integrated Receivables Automation Solutions

- Enhanced Cash Flow: Accelerating the order-to-cash cycle leads to improved liquidity and working capital management.

- Reduced Days Sales Outstanding (DSO): Streamlining collections and cash application processes shortens the time to convert receivables into cash.

- Improved Accuracy: Minimizing manual data entry reduces errors and discrepancies in financial records.

- Operational Efficiency: Automating routine tasks allows AR teams to focus on strategic activities, enhancing productivity.

- Better Customer Relationships: Timely and accurate invoicing, coupled with efficient dispute resolution, enhances customer satisfaction.

Challenges in Traditional Accounts Receivable Processes

Traditional AR processes often involve manual tasks, leading to inefficiencies such as:

- Delayed Invoicing: Manual preparation and dispatch of invoices can result in payment delays.

- Inefficient Collections: Lack of systematic follow-ups may lead to increased overdue accounts.

- High Error Rates: Manual data entry is prone to errors, causing discrepancies in financial records.

- Limited Visibility: Fragmented systems hinder real-time insights into receivables status and cash flow.

The Role of Automation in Accounts Receivable Management

Automation plays a pivotal role in transforming AR management by:

- Streamlining Processes: Automating repetitive tasks reduces manual effort and accelerates workflows.

- Enhancing Data Accuracy: Automated data capture minimizes errors and ensures consistency.

- Providing Real-Time Insights: Advanced analytics offer visibility into receivables performance and customer behavior.

- Facilitating Proactive Decision-Making: AI-driven insights enable businesses to anticipate issues and take corrective actions promptly.

Selecting the Right Integrated Receivables Automation Solution

When choosing an integrated receivables automation solution, consider the following factors:

- Scalability: Ensure the solution can grow with your business and handle increasing transaction volumes.

- Integration Capabilities: The solution should seamlessly integrate with existing ERP and accounting systems.

- User-Friendliness: A user-friendly interface facilitates adoption and minimizes training requirements.

- Customization: The ability to tailor the solution to specific business needs enhances its effectiveness.

- Vendor Support: Robust customer support and ongoing updates are crucial for long-term success.

Implementation Strategies for Integrated Receivables Automation

To successfully implement an integrated receivables automation solution:

- Assess Current Processes: Evaluate existing AR workflows to identify pain points and areas for improvement.

- Define Clear Objectives: Set measurable goals, such as reducing DSO or improving cash application rates.

- Select the Appropriate Solution: Choose a solution that aligns with your business requirements and integrates with your systems.

- Develop an Implementation Plan: Outline a detailed plan, including timelines, resource allocation, and key milestones.

- Train the Team: Provide comprehensive training to ensure users are proficient with the new system.

- Monitor and Optimize: Continuously track performance metrics and refine processes for ongoing improvement.

Benefits of Integrated Receivables Automation Solutions

- Enhanced Efficiency: Reduces manual intervention, minimizing errors and processing time.

- Improved Cash Flow: Accelerates collections and cash application, ensuring quicker access to funds.

- Accurate Forecasting: Provides real-time visibility into receivables data for better financial planning.

- Customer Experience: Enhances customer interactions with personalized communications and self-service portals.

- Cost Savings: Lowers operational costs by automating repetitive tasks and reducing days sales outstanding (DSO).

Implementing Integrated Receivables Automation Solutions

- Assessing Business Needs

- Identifying pain points in the current AR process.

- Determining automation requirements based on transaction volume and complexity.

- Choosing the Right Solution

- Evaluating vendors based on features, scalability, and integration capabilities.

- Ensuring compatibility with existing ERP and financial systems.

- Change Management and Training

- Preparing AR teams for digital transformation.

- Providing comprehensive training for effective solution adoption.

- Data Integration and Migration

- Ensuring seamless data integration from legacy systems.

- Migrating historical data securely to the new platform.

- Continuous Monitoring and Optimization

- Regularly evaluating solution performance and making adjustments.

- Leveraging analytics for ongoing process improvement.

Challenges in Implementing Integrated Receivables Automation

- Data Security and Compliance: Ensuring compliance with data protection regulations.

- System Integration Complexities: Integrating with diverse ERP and payment systems.

- Change Resistance: Overcoming resistance from employees accustomed to manual processes.

- Cost and ROI Justification: Balancing implementation costs with expected benefits.

How Emagia Empowers Integrated Receivables Automation

Emagia’s AI-driven Integrated Receivables Automation Solution revolutionizes AR management by:

- Seamlessly Integrating AR Processes: From credit management to cash application, Emagia’s platform unifies all AR functions.

- Advanced AI and Analytics: Utilizing predictive analytics for accurate cash forecasting and risk management.

- Scalable and Secure Platform: Ensuring data security with compliance to global standards.

- Enhanced Customer Experience: Offering self-service portals for improved customer communication and payment processing.

- Customizable Workflows: Tailoring automation workflows to suit unique business needs.

Emagia’s comprehensive solution not only optimizes operational efficiency but also enhances financial decision-making, driving growth and profitability.

FAQs About Integrated Receivables Automation Solutions

What is an Integrated Receivables Automation Solution?

An Integrated Receivables Automation Solution consolidates all accounts receivable processes, including invoicing, collections, cash application, and deductions, into a single platform, enhancing efficiency and accuracy.

Why is Receivables Automation Important?

Receivables automation minimizes manual tasks, reduces errors, accelerates cash flow, and provides real-time visibility into financial data, enabling better decision-making.

How Does AI Enhance Receivables Automation?

AI enhances receivables automation by improving cash matching accuracy, optimizing collection strategies, and providing predictive analytics for cash flow forecasting.

Can Integrated Receivables Automation Solutions Integrate with ERP Systems?

Yes, modern solutions are designed to seamlessly integrate with ERP and financial systems, ensuring data consistency and operational continuity.

What Are the Key Features to Look for in a Receivables Automation Solution?

Key features include automated invoicing, AI-powered cash application, intelligent collections management, and real-time analytics and reporting.

How Does Emagia’s Solution Stand Out?

Emagia’s solution leverages advanced AI, predictive analytics, and customizable workflows, offering a comprehensive platform for end-to-end receivables automation.

Conclusion

Integrated Receivables Automation Solutions are transforming the way businesses manage accounts receivable. By leveraging automation, AI, and data analytics, these solutions enhance operational efficiency, accelerate cash flow, and improve customer experiences. Emagia’s advanced platform empowers businesses to streamline their AR processes, enabling growth and profitability.