In financial operations, human error is a persistent challenge—particularly in Accounts Payable (AP) and Accounts Receivable (AR). Errors such as incorrect invoice amounts, overlooked purchase order mismatches, and duplicate payments can lead to significant financial and operational setbacks. As businesses scale, the volume of invoices and payments escalates, further complicating efforts to maintain accuracy and efficiency.

The emergence of Intelligent Document Processing (IDP) offers a transformative solution to these challenges. By automating manual tasks, IDP minimizes the risk of human error and enhances the speed and accuracy of AP and AR processes. Solutions like GiaDocsAI leverage advanced IDP capabilities to streamline financial workflows, reduce mistakes, and improve overall operational efficiency.

In this article, we explore how IDP automation is transforming AP and AR processes by eliminating human error and optimizing financial operations.

The Common Human Errors in AP & AR

Before examining how IDP addresses these issues, it’s important to understand the prevalent types of human errors that occur in AP and AR departments:

- Data Entry Errors: Manual data entry is prone to typographical errors, such as incorrect invoice amounts or vendor information. Inaccurate data on any scale can lead to incorrect payments or delays in processing invoices, disrupting cash flow.

- Duplicate Payments: Duplicate payments are a frequent issue in AP, often arising from invoices being inadvertently entered into the system multiple times or from insufficient validation checks. These errors can significantly impact cash reserves and require time-intensive reconciliations to resolve.

- Matching Discrepancies: In AR, mistakes often occur when matching invoices to purchase orders or contracts. If the data isn’t accurately aligned, it can delay payment approvals and cause billing disputes.

- Late Payments: Oversights in managing due dates can lead to late payments, straining vendor relationships and potentially incurring late fees. Efficient tracking and timely processing are crucial to maintaining credibility and avoiding additional costs.

By addressing these common pitfalls, IDP automation not only reduces the likelihood of errors but also enhances the efficiency and reliability of AP and AR functions. In the following sections, we will explore the key capabilities of IDP and how they contribute to eliminating human error in financial processes.

The traditional manual approach to managing AP and AR is fraught with these challenges, making it essential for businesses to seek ways to reduce errors and optimize efficiency.

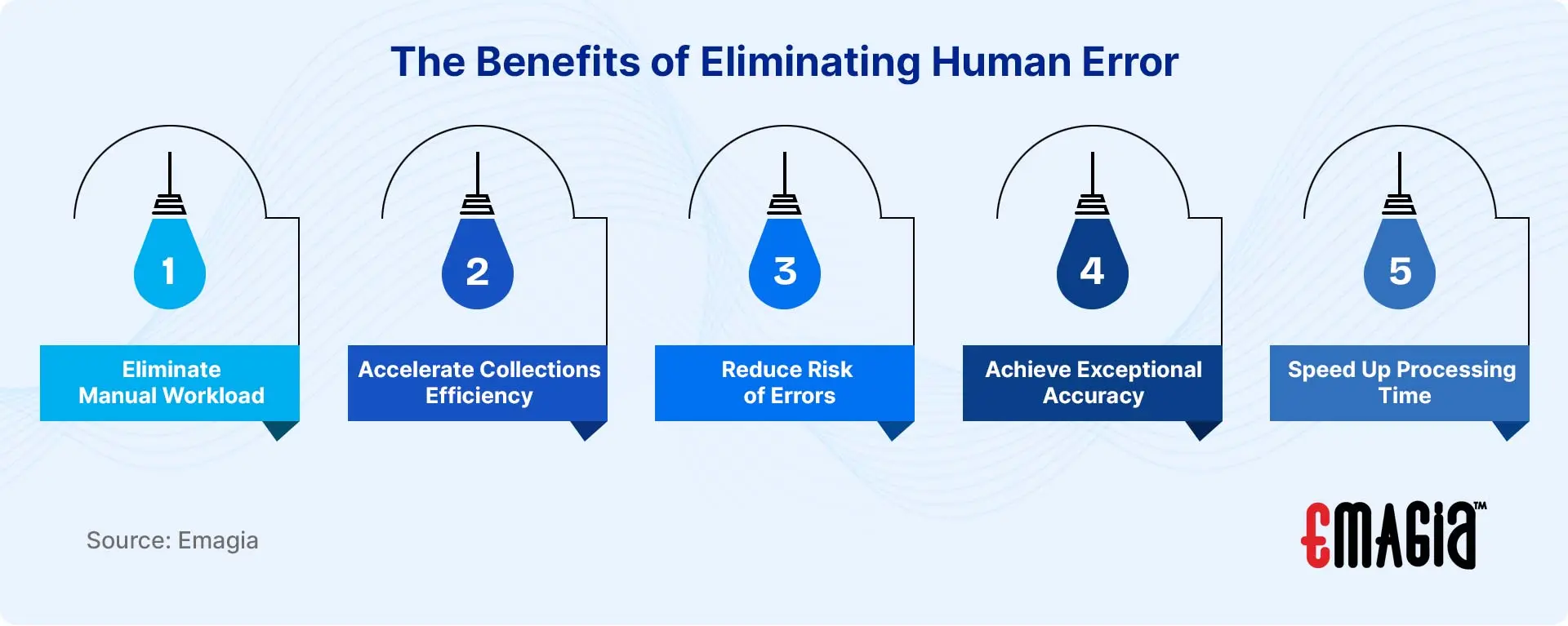

The Benefits of Eliminating Human Error

By leveraging IDP automation, businesses not only eliminate human errors but also gain several other advantages:

- Eliminate Manual Workload

Replaces time-consuming manual data extraction with intelligent automation powered by advanced AI. - Accelerate Collections Efficiency

Enhances collections operations with next-generation cognitive AI for faster and more accurate data capture. - Reduce Risk of Errors

Minimizes the risk of data entry errors by up to 80%, improving accuracy and compliance. - Achieve Exceptional Accuracy

Delivers over 99% accuracy in financial document processing, ensuring reliability and precision. - Speed Up Processing Time

Cuts down document processing time by up to 70%, accelerating your financial workflows.

How IDP Automation Eliminates Human Error

IDP is transforming AP and AR departments by automating the process of data extraction, validation, and matching, virtually eliminating the possibility of human error. Here’s how:

1. Automated Data Extraction

Optical Character Recognition (OCR) and machine learning, which is used by best-in-class IDP platforms like GiaDocs, to automatically capture data from invoices, receipts, purchase orders, and contracts. These technologies can extract key information, such as invoice numbers, amounts, vendor names, and dates, directly from documents—whether they are in paper form, PDFs, or images.

By automating this process, IDP eliminates the risk of typographical errors that can occur when manually entering data into systems. Invoices are processed with high accuracy, and the risk of incorrect data entries is significantly reduced. This ensures that only accurate, verified data enters the system, minimizing errors right from the start.

2. Automated Validation and Verification

IDP systems don’t just extract data; they also validate it. For example, when processing invoices in AP, the system cross-references extracted data with purchase orders or contracts to ensure consistency. This automated matching process reduces the likelihood of misapplied payments, preventing discrepancies between invoices and orders that can lead to financial errors.

In AR, IDP can also automatically match incoming payments to outstanding invoices, ensuring that each payment is applied to the correct account. This removes the possibility of applying a payment to the wrong invoice due to human oversight or mismanagement.

3. Real-Time Duplicate Detection

Duplicate payments are a significant source of errors in AP. IDP can automatically detect duplicate invoices by comparing invoice numbers, amounts, and vendor details against the records already in the system. If an invoice has been processed previously, the system flags it for review, ensuring that no double payment occurs.

For example, if a vendor mistakenly submits the same invoice twice, the IDP system will identify the duplicate and alert the AP team to prevent payment. This proactive detection minimizes the financial impact of duplicate payments and ensures better cash flow management.

4. Improved Workflow Automation

Another way IDP eliminates human error is by automating repetitive tasks and creating a streamlined workflow. In AP, for instance, invoices are automatically routed to the appropriate department or manager for approval, based on predefined rules. This eliminates the need for manual intervention and reduces the chances of approval delays or misplacement of invoices.

In AR, the automation of payment reminders and follow-ups reduces the chance of missing payment deadlines. With AI-driven solutions, overdue invoices are flagged, and teams can take action immediately, improving collections and reducing the risk of late payment fees.

5. Accurate Reporting and Analytics

IDP systems can provide real-time insights and reports on the status of AP and AR processes. The data extracted and validated by IDP is compiled into dashboards, giving finance teams access to accurate financial reports. These reports help in making informed decisions without relying on manual calculations that could lead to mistakes.

For example, finance teams can use IDP-powered dashboards to track overdue invoices, monitor payment trends, and gain insights into vendor performance—all with real-time accuracy. With these insights at their fingertips, businesses can act more swiftly and effectively, reducing the chance of errors that arise from outdated information.

How Emagia Helps: IDP-Powered AP & AR Automation with GiaDocsAI

At Emagia, we empower finance teams with GiaDocsAI, an AI-driven Intelligent Document Processing (IDP) solution designed to eliminate human error in Accounts Payable (AP) and Accounts Receivable (AR).

🔹 Eliminate costly financial errors with GiaDocsAI.

Enhance efficiency, ensure accuracy, and future-proof your AP & AR operations with AI-driven automation.

🔹 Lower Operational Costs

Reduces lockbox fees and decreases overall AR and AP processing costs.

🔹 Boost Team Productivity & Morale

Automates repetitive, low-value tasks—empowering teams to focus on more meaningful work.

🔹 Enable Strategic Resource Allocation

Frees up time and resources, allowing finance teams to concentrate on high-impact, strategic initiatives.

🌐 Discover how GiaDocsAI can transform your financial workflows today! (https://www.emagia.com/products/gia-docs-intelligent-document-processing/)

Conclusion

Eliminating human error in AP and AR processes is crucial for any organization looking to improve its financial operations. By adopting IDP automation, businesses can not only reduce the risk of costly mistakes but also achieve higher efficiency, greater accuracy, and enhanced financial control. With GiaDocs AI, businesses are equipped with a powerful solution to automate their AP and AR processes, driving better decision-making and healthier financial outcomes.

As organizations continue to embrace automation, IDP will play an essential role in streamlining financial workflows, safeguarding against errors, and ensuring long-term financial success.

FAQ: Eliminating Human Error in AP & AR with IDP Automation

1. What are the most common human errors in AP and AR?

- Data Entry Mistakes – Typographical errors in invoices, amounts, or vendor details.

- Duplicate Payments – Paying the same invoice twice due to manual processing.

- Matching Errors – Incorrectly linking invoices to purchase orders (POs) or contracts.

- Late Payments – Oversights in tracking due dates lead to missed or delayed payments.

2. How does IDP automation reduce errors in financial processes?

✅ Automated Data Extraction – Uses OCR and AI to extract invoice details with high accuracy.

✅ Real-Time Validation & Verification – Matches invoices to POs and contracts, ensuring accuracy.

✅ Duplicate Detection – Flags duplicate invoices before they are processed, preventing overpayments.

✅ Workflow Automation – Automates invoice routing and approval processes to eliminate manual handling.

✅ Accurate Reporting & Analytics – Provides real-time insights into AP and AR operations.

3. Can IDP prevent duplicate payments in AP?

Yes! IDP automatically detects duplicate invoices by cross-referencing invoice numbers, vendor details, and amounts. If a duplicate is found, the system flags it before processing, ensuring no double payments.

4. How does IDP improve invoice matching in AR?

IDP automatically matches incoming payments to outstanding invoices, ensuring payments are applied correctly and reducing misallocated funds. This prevents disputes and improves cash flow management.

5. What are the key benefits of eliminating human error in AP & AR?

🚀 Increased Efficiency – Automates repetitive tasks, freeing finance teams for strategic work.

💰 Cost Savings – Reduces labor costs and prevents financial losses from duplicate payments.

⚡ Faster Processing Times – Speeds up invoice approvals and payment processing.

📊 Better Financial Control – Real-time insights help businesses track cash flow and optimize financial decision-making.