The financial industry is going through major changes driven by advancements in artificial intelligence (AI) and natural language processing (NLP). These technologies are revolutionizing document processing, transforming how financial institutions manage data, ensure compliance, and make strategic decisions. In this article, we explore how NLP and AI are shaping the future of finance and why businesses must embrace these innovations to stay competitive.

The Challenges of Traditional Document Processing in Finance

In the fast-paced world of finance, managing large volumes of unstructured data—from contracts and invoices to regulatory reports and customer communications—has always been a daunting task. Traditional methods of document processing involve manual data entry which are:

Time-consuming: Delays in processing documents can slow down critical operations like loan approvals or accounts reconciliation.

Error-prone: Manual handling increases the risk of mistakes, leading to compliance breaches or financial losses.

Costly: Labor-intensive processes consume significant resources, diverting focus from strategic initiatives.

The need for a smarter, faster, and more accurate approach is clear. Enter AI and NLP.

What is Natural Language Processing (NLP)?

NLP enables machines to understand, interpret, and generate human language. In the context of document processing, NLP allows systems to:

- Extract key information from unstructured text.

- Classify documents based on their content.

- Identify trends and insights from large datasets.

This capability is especially transformative for the finance industry, where understanding and managing complex textual data is crucial.

How NLP and AI Are Revolutionizing Document Processing

Automated Data Extraction AI-powered solutions equipped with NLP can extract relevant data from various documents, such as:

- Financial statements

- Tax forms

- Contracts and agreements

Tools like GiaDocsAI use advanced AI models to automate data extraction, ensuring speed and accuracy.Improved Compliance Management Compliance is a major challenge for financial institutions. NLP helps by analyzing documents to:

- Identify potential compliance risks.

- Ensure adherence to regulations.

- Provide audit trails for accountability.

Enhanced Customer Experience By streamlining processes like loan approvals and customer onboarding, AI-driven document processing reduces waiting times and improves satisfaction.

Multilingual Capabilities For global financial operations, NLP can process documents in multiple languages, breaking down barriers and ensuring consistency across regions.

Predictive Insights Advanced AI models can analyze historical data to predict future trends, enabling smarter decision-making. For example, analyzing financial reports with NLP can uncover risks or opportunities that would be hard to detect manually.

Key Benefits of AI and NLP in Finance

Adopting AI and NLP for document processing offer advantages such as:

- Scalability: Handle high volumes of documents without increasing operational costs.

- Accuracy: Minimize errors through automated validation processes.

- Efficiency: Save time by automating repetitive tasks, freeing up employees for higher-value work.

- Cost Savings: Reduce the need for manual labor and improve ROI.

These benefits are crucial for financial institutions aiming to stay competitive in a rapidly evolving landscape.

Real-World Applications of AI and NLP in Finance

Financial institutions worldwide are leveraging AI and NLP to address specific challenges:

- Accounts Payable and Receivable: Automate invoice processing and payment tracking.

- Loan Processing: Accelerate approvals by analyzing applications and supporting documents.

- Risk Management: Analyze contracts and agreements for potential risks.

- Regulatory Reporting: Ensure compliance with real-time monitoring and analysis.

These applications not only streamline operations but also enhance the quality of services provided to customers.

Why GiaDocsAI is Leading the Way

GiaDocsAI is at the forefront of this revolution, offering state-of-the-art Intelligent Document Processing (IDP) solutions tailored for finance. By combining AI and NLP, GiaDocsAI provides:

- Fast, accurate data extraction

- Seamless integration with existing systems

- Support for multilingual and complex document types

With GiaDocsAI, financial institutions can transform their document workflows, ensuring they remain agile and competitive in an evolving landscape.

The Future of Finance with NLP and AI

The role of AI and NLP in the financial sector is only expected to grow. Here are some key trends and predictions:

- Increased Personalization Financial institutions will use AI to create tailored solutions for clients. Document processing systems will not only extract data but also provide insights for hyper-personalized financial products.

- Real-Time Decision-Making AI-enabled document systems will integrate with other technologies, enabling real-time insights and faster decision-making.

- Greater Focus on Compliance Advanced AI will simplify compliance processes, reducing regulatory risks and improving audit readiness.

- Integration with Blockchain The combination of AI and blockchain will enhance security and transparency in document workflows, particularly for smart contracts and cross-border transactions.

- Adoption Across Emerging Markets As the cost of AI technology decreases, more financial institutions in emerging markets will adopt NLP-driven solutions to improve efficiency and competitiveness.

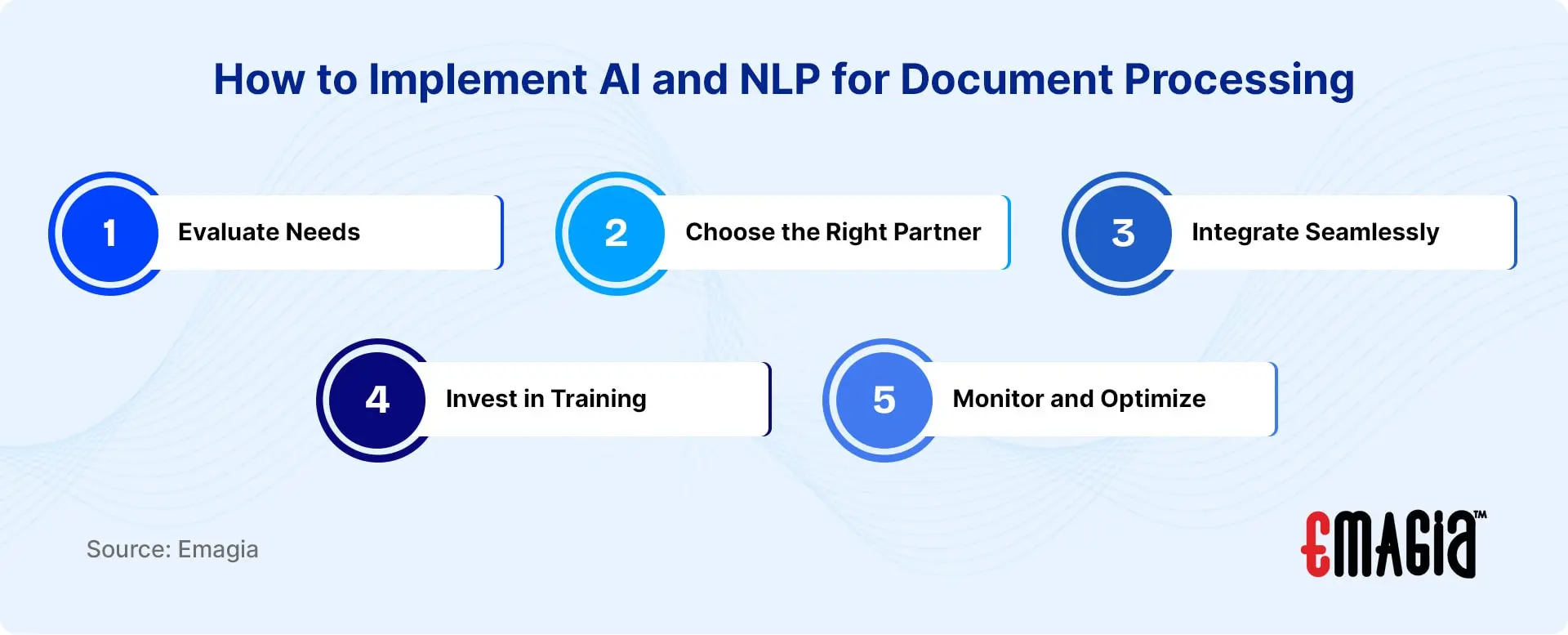

How to Implement AI and NLP for Document Processing

To successfully implement AI and NLP in financial operations, institutions should follow these best practices:

- Evaluate Needs: Conduct a thorough assessment of document workflows to identify pain points and prioritize areas for automation.

- Choose the Right Partner: Collaborate with a trusted third-party provider – one that can demonstrate years of operating excellence and/or distinctions – to ensure you have access to cutting-edge technology and expertise.

- Integrate Seamlessly: Ensure that AI solutions integrate with existing systems and processes to minimize disruption.

- Invest in Training: Equip employees with the skills and knowledge needed to work effectively with AI tools.

- Monitor and Optimize: Continuously monitor performance and refine workflows to maximize ROI.

Conclusion

The future of finance is here, and it is powered by AI and NLP. These technologies are not just enhancing document processing; they are redefining how financial institutions operate. By adopting intelligent solutions like GiaDocsAI, businesses can unlock new levels of efficiency, accuracy, and strategic advantage.

For financial institutions ready to embrace the future, the time to act is now. Implementing solutions like GiaDocsAI can set the foundation for success, ensuring that your business thrives in an increasingly digital world.

FAQs

1. What is Intelligent Document Processing (IDP)?

Intelligent Document Processing (IDP) leverages AI and NLP to automate the extraction, classification, and processing of information from structured and unstructured documents, improving accuracy and efficiency.

2. How does NLP benefit financial institutions?

NLP enables financial institutions to process and analyze large volumes of textual data quickly and accurately, enhancing compliance, decision-making, and customer service.

3. Can AI handle multilingual documents?

Yes, AI-powered tools like GiaDocsAI can process documents in multiple languages, ensuring global consistency and accessibility.

4. How does AI improve compliance in finance?

AI systems analyze documents for potential risks, ensure adherence to regulatory standards, and provide comprehensive audit trails, reducing compliance risks.

5. Is it expensive to implement AI for document processing?

While there is an initial investment, the long-term benefits of reduced labor costs, increased efficiency, and improved accuracy often result in significant ROI for financial institutions.

Discover how GiaDocsAI can revolutionize your document processing workflows.Contact us today to learn more!