CFOs have a complex role to play when it comes to spending, particularly on digital initiatives. Their role is double-edged; one that mandates them to control and exercise due diligence on spending and the other of their need for intelligent data and insights to make informed strategic decisions.

While data and information about the operations and business processes of the organization come from internal sources, the external sources provide insight into the market and economy that are equally important elements influencing the growth and sustainability of the businesses. Capturing and analyzing internal and external data and presenting them in the most intelligent and actionable format, and as well intelligently acting on them need a seamlessly integrated digital application that leverages emerging technologies.

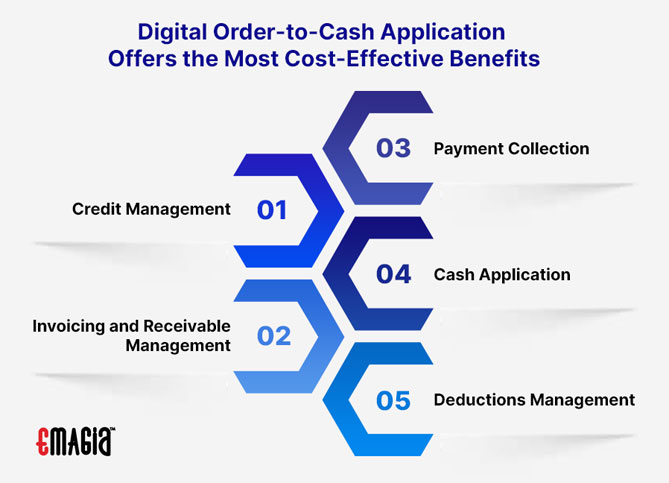

Order-to-Cash (OTC or O2C) is arguably one of the business processes most CFOs have a keen eye on, as it affects the three strategic goals of an enterprise, viz., topline, bottom line, and cash flow. CFOs are expected to ensure that the best digital O2C application that offers the most cost-effective benefits – mainly the following elements – are selected and adopted in their organization:

Topline

- Order Management: A digital OTC application powered by digital channels, AI, and ML checks the availability of inventory or service products and the credit status of the customer, among others, to enable accurate and quick order processing.

- Order Fulfillment: RPA and AI automate workflow for order fulfillment of merchandise orders including in micro fulfillment centers of e-commerce or online marketplaces and granting access to users in the case of digital services and XaaS (Anything as a Service), this getting efficient with a digital platform.

- Inventory Optimization: An integrated OTC or ERP application along with Analytics, IoT, ML, and AI helps businesses achieve optimal inventory through an integrated environment that includes customer orders, inventory status, purchase orders, and production orders.

- Customer Experience: Customer experience is enhanced through smooth and efficient management of orders, receivables, credit, etc., facilitated by a digital OTC, digital channels, and CRM powered by IoT and AI.

Bottomline

- Order Processing Cost: The OTC automation with the help of AI and RPA reduces the time and resources required to manage an order from end to end including logistics.

- Finance Cost: RPA and Analytics helps enhance the efficiency in invoicing, receivable management, and payment collection to minimize the need for credit or working capital loan.

- Bad Debts: The credit check process leveraging digital channels, analytics, and ML will be of use in reducing the probability of receivables becoming bad debts.

Cash Flow

- Credit Management: The AI, ML, and Analytics enabled digital tools offer a credit check facility to help companies collect the payment on the due date to improve the predictability of cash flow.

- Invoicing and Receivable Management: RPA, ML, AI, and Analytics allow timely and accurate invoicing to ensure on-time collection of payment through automated payment reminders, or aging analysis, resolution of invoicing errors, and collection of the payment before it is overdue.

- Payment Collection: Digital OTC leveraging RPA, AI, and Analytics helps companies define the point where the outstanding invoices are followed up directly and when they are either written off as bad debt or passed to third-party collections or factoring agencies.

- Cash Application: Payments collected must be applied against the proper invoice of the relevant customer. Automating this process with the help of AI and RPA facilitates quicker AR reconciliation and follow-ups to drive speedy collection.

- Deductions Management: Automating the review and adjustment of deductions like returns, cash discount, credit notes, etc, against the relevant invoice with the support of ML, AI, and Analytics will smoothen cash application and resultantly the follow-up and collection process.