Creating a comprehensive credit application checklist spreadsheet template is essential for businesses aiming to streamline their credit approval processes and assess customer creditworthiness effectively. This guide provides an in-depth exploration of the key components, benefits, and implementation strategies for such templates.

Understanding the Credit Application Checklist Spreadsheet Template

A credit application checklist spreadsheet template is a structured tool that assists businesses in organizing and evaluating all necessary information when processing credit applications. It ensures that no critical detail is overlooked, thereby facilitating informed credit decisions.

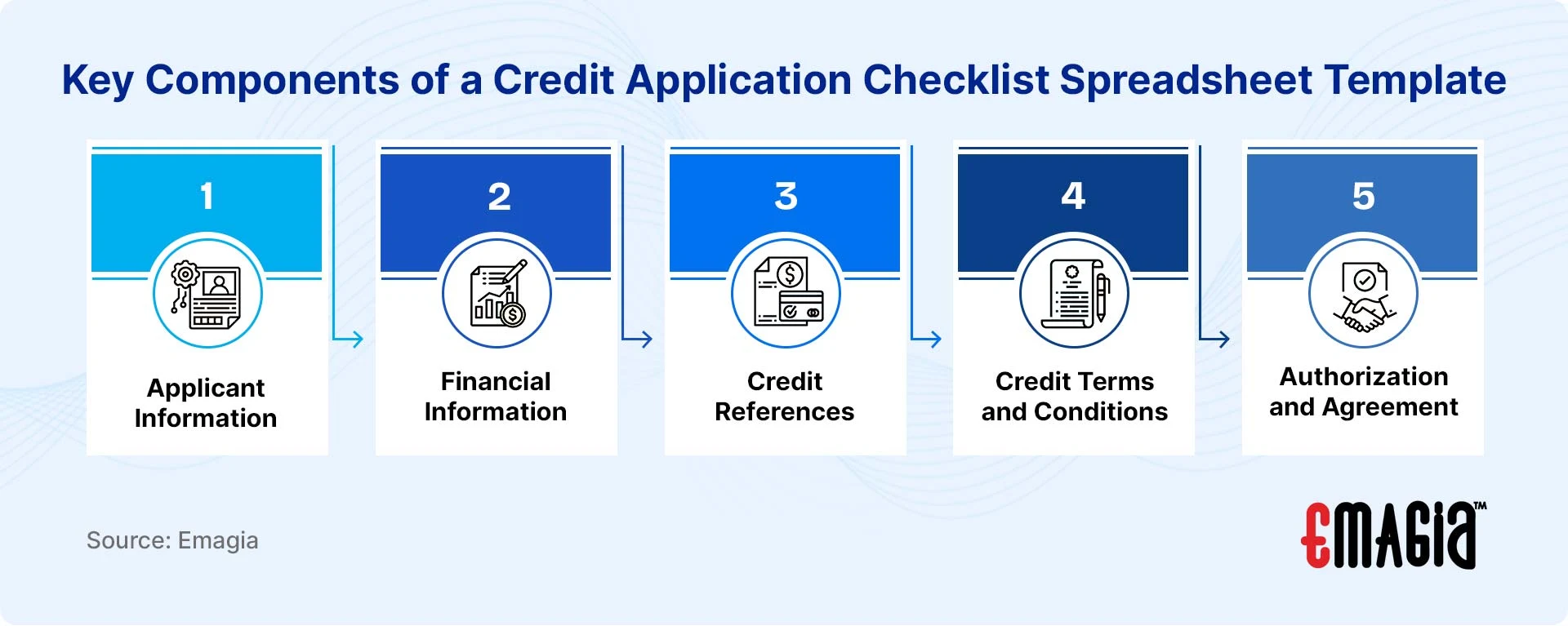

Key Components of a Credit Application Checklist Spreadsheet Template

- Applicant Information

- Legal Name and Contact Details: Collect the applicant’s full legal name, address, phone number, and email.

- Business Structure: Identify whether the applicant is a sole proprietorship, partnership, corporation, etc.

- Financial Information

- Bank References: Include bank names, account numbers, and contact persons.

- Financial Statements: Request recent balance sheets, income statements, and cash flow statements.

- Credit References

- Trade References: List suppliers or vendors with whom the applicant has existing credit arrangements, including contact information and payment history.

- Credit Terms and Conditions

- Credit Limit Requested: Specify the amount of credit the applicant seeks.

- Payment Terms: Define the agreed-upon payment schedule and any applicable interest rates or fees.

- Authorization and Agreement

- Signature: Obtain the applicant’s signature to authorize credit checks and agree to the terms.

- Date: Record the date of application submission.

Benefits of Using a Credit Application Checklist Spreadsheet Template

- Consistency: Ensures that every credit application is processed uniformly, reducing errors and omissions.

- Efficiency: Streamlines the credit evaluation process, saving time and resources.

- Risk Mitigation: Facilitates thorough assessment of creditworthiness, thereby minimizing potential financial risks.

How to Create and Implement a Credit Application Checklist Spreadsheet Template

- Design the Template

- Use spreadsheet software like Microsoft Excel or Google Sheets to create the template.

- Organize sections clearly, with distinct headings for each component.

- Customize to Your Business Needs

- Tailor the template to include specific information relevant to your industry and business requirements.

- Integrate into the Credit Application Process

- Train your team on utilizing the template effectively.

- Incorporate the template into your standard operating procedures for credit applications.

Common Mistakes to Avoid

- Incomplete Information: Ensure all required fields are filled out to prevent delays in processing.

- Outdated Data: Regularly update the template to reflect current policies and regulatory requirements.

- Lack of Customization: Avoid using generic templates without modifications that suit your specific business needs.

Enhancing the Credit Application Process with Emagia

Emagia offers advanced solutions that automate and optimize the credit application process. By integrating Emagia’s digital credit application tools, businesses can achieve:

- Automated Data Collection: Streamline the gathering of applicant information through digital forms.

- Real-Time Credit Analysis: Utilize AI-driven analytics to assess creditworthiness instantly.

- Improved Compliance: Ensure adherence to regulatory standards with automated checks and balances.

Implementing Emagia’s solutions can lead to faster credit approvals, reduced errors, and enhanced customer satisfaction.

Frequently Asked Questions

What is a credit application checklist spreadsheet template?

A structured tool that helps businesses organize and evaluate necessary information during the credit application process.

Why is a credit application checklist important?

It ensures consistency, efficiency, and thoroughness in assessing an applicant’s creditworthiness, thereby reducing financial risks.

Can I customize the credit application checklist template?

Yes, it’s advisable to tailor the template to align with your business’s specific needs and industry requirements.

How does Emagia enhance the credit application process?

Emagia provides digital tools that automate data collection, offer real-time credit analysis, and ensure compliance, streamlining the entire credit application workflow.

Where can I find credit application checklist templates?

Templates are available from various online resources, including financial websites and template providers.

By implementing a well-structured credit application checklist spreadsheet template, businesses can significantly improve their credit approval processes, ensuring thorough evaluations and informed decisions.