Drive Efficiency while Transforming Customer Experience

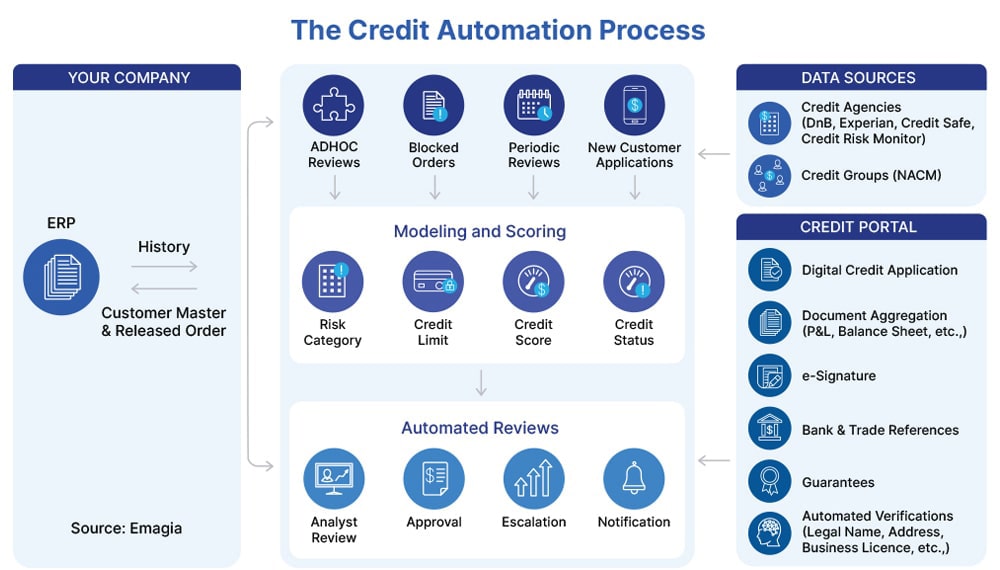

B2B credit automation eliminates manual tasks from credit, accelerates credit processing and helps onboard customers faster while minimizing the credit risk. In today’s new normal, B2B credit automation is gaining more prominence with most of the finance staff still operating from a work-from-home environment.

In pursuit of digital transformation, companies succeed with process transformation as a starting point and catalyst for broader enterprise transformation. The digital transformation of accounts receivable (AR) management provides an excellent starting point. The virtues are tremendous gains in efficiency, knowledge and control combined with superior customer experience.

State-of-the-art intelligent technology is transforming AR management and the order-to-cash (O2C) process, beginning with credit management, the focus of this blog. Future blogs will address other O2C components.

Transforming Credit Risk Management

Critical goals of transforming O2C are to improve customer experience, increase operational efficiency, and support business growth. Sound digital credit systems scale with growth while minimizing risk and bad debt.

How easy do customers find doing business with you? How efficient are your processes? How much friction is there in customer transactions? A good digital credit system optimizes your credit process and removes friction.

Gathering Credit Information

There are ten essential elements in a digital credit process. The first is the credit application. Today most companies ask the customer to complete a paper or pdf credit application form. Someone then must review the document for completeness, return to the prospect if it is incomplete, then pass it on.

The benefits of an online digital credit application accrue immediately. A digital credit form conducts automatic verification on mandatory fields. It presents terms with a check-off by the prospect and prompts the upload of required documents such as financial statements, resale certificates, or personal guarantees.

This efficiency is powerful. Some organizations have spent time and effort to build such an app in-house, but today there are many solutions available that are readily configured and activated. Whether SaaS or on-premises, a digital credit application is the first step in transforming the credit process.

Digital signatures, long accepted for consumers and businesses, are the next element of digital credit efficiency. A good digital credit system allows for multiple signatories and provides an audit trail.

A third element is digital reference checking. Traditional checks with trade and bank references involve time-consuming, mundane activities. A digital credit system presents a simple electronic form to contacts, making their response easy. It also automatically sends reminders. As a result, digital reference checks save time.

The fourth essential is capturing credit bureau information, such as D&B, Experian, or NACM’s BCS. These organizations make information available through APIs. A good credit application integrates with the APIs to bring information into the credit application system, putting all the necessary information in one place.

Evaluating the Information

The fifth element is a core element of an effective digital credit system: credit scoring. Most organizations enter data into various Excel spreadsheets according to product line and business unit. Then they route the Excel sheets for review.

But a digital credit system automates credit scoring, using your models to evaluate applications and reference information. The system includes internal records of existing customers. Automated credit scoring provides consistency and control in the approval process.

Once scoring is complete, a digital system automatically sets the credit limit based on rules your organization has defined. It classifies customers into various risk levels according to your definitions. As a result, you can create consistent credit limits and policies. Rule-driven, system-assigned credit limits drive productivity, especially for those with a high volume of credit applications.

With scoring completed and credit limit set, a digital system automatically sends notifications to approvers according to risk level, dispensing with email and missed phone calls. Approvers are requested and automatically reminded of credit applications awaiting action.

Additional Elements

Periodically companies need to review and analyze customers. A good digital credit system monitors the portfolio. It alerts you when a customer is due for review and automatically conducts it. It looks at the payment record. Are there changes to the account or a request for a higher credit limit? Is there a concern about bankruptcy? With all the customer data in one location, the system reviews customers according to a schedule, alerting you to the results.

A digital credit system also eliminates repetitive manual work through the integration of robotic process automation. Software “bots” take over repetitive activities in the credit process. For example, going to the state government website to pull business license information for every application is time-consuming. But a bot can go to the state website and verify the customer’s business license for you. Such bots work throughout an O2C digital system taking care of such routine tasks 24/7.

The final element in a digital credit process is the use of cognitive digital assistance. Your customers are accustomed to digital assistants (DAs) like Siri and Alexa in their personal lives. Now leading companies increasingly employ DAs in a B2B setting. A DA supports internal staff, answering questions about the status of credit applications or scores and acting on directives such as “send this status to the sales rep.” Thus, DAs expedite the accomplishment of daily activities.

Altogether, these elements greatly accelerate the credit application process. Instead of waiting a week or two for a credit decision, an applicant can get approval the same day. The customer enjoys a positive experience, gaining nearly immediate results on their credit application. Internally, credit departments see excellent productivity and efficiency gains. They can shift focus to higher risk and reward prospects. And because the automated processes scale, companies can grow without adding more credit staff.

Andrew Annacone of the strategic advisory firm TechNexus has said, “Process transformation can create significant value and adopting technology in these areas is fast becoming table-stakes.” He notes that digital transformation is not monolithic, and business process transformation can lead the way. Given its customer-facing aspects, the O2C process, specifically credit management, is an excellent place to get started.