In today’s fast-paced business environment, managing accounts receivable efficiently is crucial for maintaining healthy cash flow. Automated Payment Collection Software has emerged as a vital tool for businesses aiming to streamline their collection processes, reduce manual efforts, and improve overall financial performance. This comprehensive guide delves into the intricacies of Automated Payment Collection Software, exploring its features, benefits, implementation strategies, and much more.

Understanding Automated Payment Collection Software

Automated Payment Collection Software is a digital solution designed to streamline and optimize the process of collecting payments from customers. By leveraging automation, it reduces manual intervention, accelerates cash flow, and minimizes errors, leading to improved financial performance.

Key Features of Automated Payment Collection Software

- Automated Payment Reminders: The software sends timely reminders to customers about upcoming or overdue payments, reducing the need for manual follow-ups.

- Payment Scheduling: Customers can schedule payments in advance, ensuring timely transactions and improved cash flow management.

- Real-Time Payment Tracking: Businesses can monitor payment statuses in real-time, allowing for prompt action on overdue accounts.

- Integration with ERP Systems: Seamless integration with Enterprise Resource Planning systems ensures real-time synchronization of accounts receivable data.

- Customizable Collection Strategies: Collection managers can build and implement specific strategies tailored to their department’s needs.

- Customer Self-Service Portals: Enhances customer satisfaction by providing convenient payment options and access to account information.

Benefits of Implementing Automated Payment Collection Software

- Improved Cash Flow: By accelerating the collection process, businesses can maintain a healthier cash flow.

- Reduced Manual Effort: Automation minimizes the need for manual intervention, allowing staff to focus on more strategic tasks.

- Enhanced Accuracy: Automated systems reduce the likelihood of human errors in the collection process.

- Better Customer Relationships: Timely reminders and convenient payment options enhance the customer experience.

- Data-Driven Insights: Access to real-time data and analytics aids in making informed decisions.

How to Choose the Right Automated Payment Collection Software

- Assess Your Business Needs: Identify the specific requirements of your accounts receivable process.

- Evaluate Features: Ensure the software offers the necessary features such as automated reminders, payment scheduling, and real-time tracking.

- Consider Integration Capabilities: The software should integrate seamlessly with your existing systems, such as ERP and CRM platforms.

- Scalability: Choose a solution that can grow with your business.

- User-Friendliness: The interface should be intuitive for both your team and your customers.

- Vendor Support: Reliable customer support is crucial for addressing any issues that may arise.

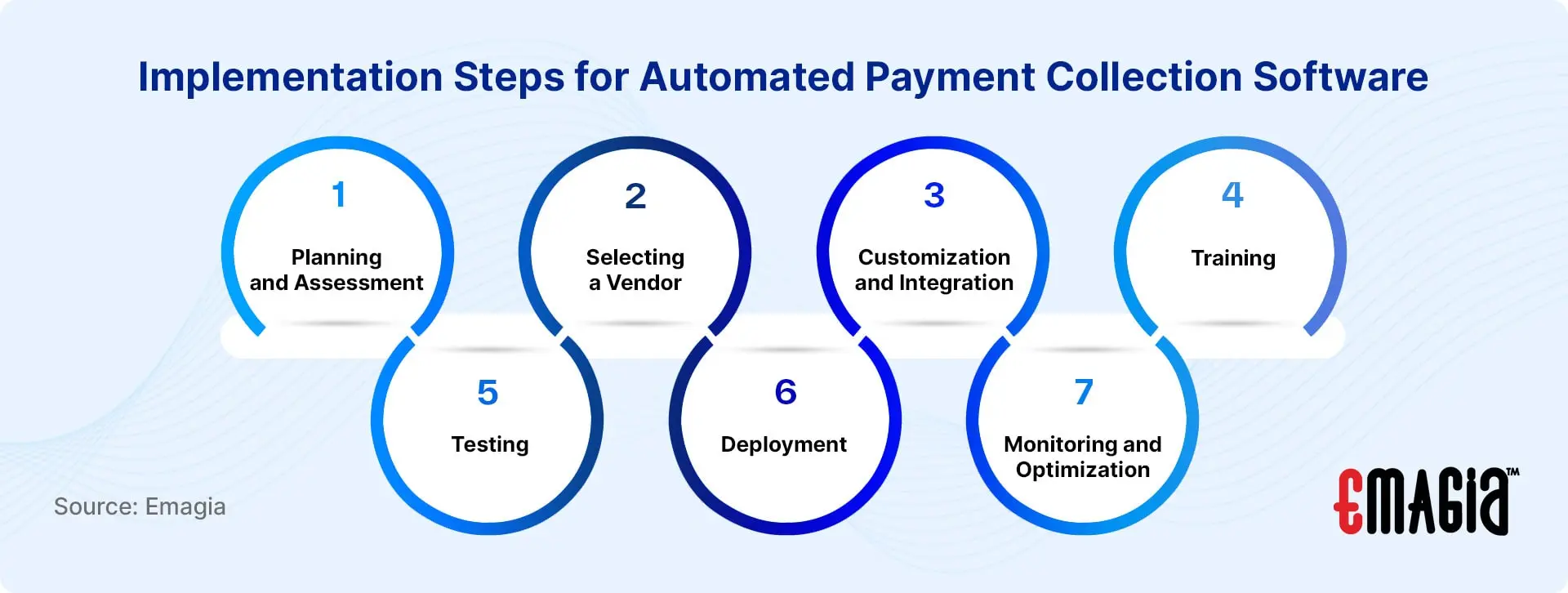

Implementation Steps for Automated Payment Collection Software

- Planning and Assessment: Evaluate your current collection processes and identify areas for improvement.

- Selecting a Vendor: Choose a reputable provider that aligns with your business needs.

- Customization and Integration: Tailor the software to fit your processes and integrate it with existing systems.

- Training: Provide comprehensive training to your team to ensure smooth adoption.

- Testing: Conduct thorough testing to identify and resolve any issues before full deployment.

- Deployment: Roll out the software across your organization.

- Monitoring and Optimization: Continuously monitor performance and make necessary adjustments to optimize efficiency.

Challenges in Payment Collection and How Automation Addresses Them

- Delayed Payments: Automated reminders prompt customers to pay on time.

- High Operational Costs: Reducing manual tasks lowers labor costs.

- Errors in Invoicing: Automation ensures accuracy in billing and reduces discrepancies.

- Lack of Visibility: Real-time tracking provides transparency into the collection process.

- Customer Disputes: Clear communication and accurate records help in resolving disputes efficiently.

Industry Applications of Automated Payment Collection Software

- Manufacturing: Manages large volumes of invoices and streamlines the collection process.

- Healthcare: Facilitates timely payments from patients and insurance companies.

- Retail: Handles high transaction volumes and manages customer payment plans.

- Utilities: Ensures timely collection of recurring payments from customers.

- Financial Services: Manages loan repayments and other financial obligations efficiently.

Challenges in Implementing Automated Payment Collection Software

While Automated Payment Collection Software offers numerous advantages, businesses may encounter several challenges during implementation:

1. Integration with Existing Systems

Integrating new software with legacy systems can be complex. Ensuring compatibility with current Enterprise Resource Planning (ERP) and accounting platforms is crucial for seamless data flow.

2. Data Security Concerns

Handling sensitive financial information necessitates robust security measures. Implementing encryption and adhering to compliance standards are essential to protect data integrity.

3. User Adoption and Training

Employees may resist transitioning from manual processes to automated systems. Providing comprehensive training and demonstrating the software’s benefits can facilitate smoother adoption.

4. Customization Needs

Businesses often require tailored solutions to meet specific operational needs. Selecting software that offers customization options ensures alignment with unique business processes.

5. Cost Considerations

The initial investment in automated systems can be significant. However, the long-term benefits, such as reduced manual labor and improved cash flow, often justify the expenditure.

6. Maintaining Data Accuracy

Ensuring the accuracy of data during migration and ongoing operations is vital. Regular audits and validation checks can help maintain data integrity.

7. Managing Customer Communication

Automated communications must be carefully managed to avoid appearing impersonal. Balancing automation with personalized interactions can enhance customer relationships.

8. Regulatory Compliance

Adhering to industry regulations and standards is mandatory. Implementing software that supports compliance can mitigate legal risks.

By proactively addressing these challenges, businesses can successfully implement Automated Payment Collection Software and reap its numerous benefits.

Future Trends in Automated Payment Collection

The landscape of payment collection is continually evolving. Key trends shaping the future include:

1. Artificial Intelligence and Machine Learning

AI and ML are enhancing predictive analytics, allowing businesses to forecast payment behaviors and optimize collection strategies.

2. Blockchain Technology

Blockchain offers transparent and secure transaction records, reducing fraud and increasing trust in payment processes.

3. Mobile Payment Integration

The rise of mobile payments necessitates systems that seamlessly integrate with mobile platforms, providing customers with convenient payment options.

4. Enhanced Customer Self-Service Portals

Advanced self-service portals empower customers to manage their payments, view invoices, and communicate with service providers, improving satisfaction and reducing administrative burdens.

5. Real-Time Payment Processing

The demand for real-time transactions is growing, requiring systems that can process payments instantly and update records without delay.

6. Advanced Data Analytics

Leveraging big data analytics enables businesses to gain deeper insights into payment trends, customer behaviors, and process efficiencies.

7. Increased Focus on Cybersecurity

As digital transactions rise, so does the need for robust cybersecurity measures to protect against evolving threats.

Staying abreast of these trends will help businesses remain competitive and responsive to changing market dynamics.

How Emagia Revolutionizes Automated Payment Collection

Emagia stands at the forefront of transforming accounts receivable processes through its advanced Automated Payment Collection Software. Here’s how Emagia makes a difference:

1. AI-Driven Collections Management

Emagia leverages artificial intelligence to prioritize collection activities, ensuring that high-risk accounts receive immediate attention. This strategic approach enhances recovery rates and optimizes resource allocation.

2. Comprehensive Payment Automation

With Emagia, businesses can automate the entire payment lifecycle—from invoice generation to payment reconciliation. This end-to-end automation reduces manual intervention, minimizes errors, and accelerates cash flow.

3. Real-Time Analytics and Reporting

Emagia provides real-time insights into accounts receivable performance through intuitive dashboards and reports. These analytics empower businesses to make informed decisions and proactively manage their financial health.

4. Seamless ERP Integration

Designed for compatibility, Emagia integrates effortlessly with existing ERP systems, ensuring a unified and efficient financial ecosystem. This integration facilitates data consistency and streamlines operations.

5. Enhanced Customer Experience

Emagia offers customer self-service portals, enabling clients to access their account information, make payments, and communicate regarding invoices conveniently. This transparency and ease of access improve customer satisfaction and loyalty.

By implementing Emagia’s Automated Payment Collection Software, businesses can achieve significant improvements in efficiency, accuracy, and financial performance, positioning themselves for sustained success in today’s competitive market.

Frequently Asked Questions (FAQs) About Automated Payment Collection Software

What is Automated Payment Collection Software?

Automated Payment Collection Software is a digital tool designed to streamline the process of collecting payments from customers. It automates tasks such as sending payment reminders, processing payments, and updating accounts receivable records, thereby reducing manual effort and minimizing errors.

How does Automated Payment Collection Software improve cash flow?

By automating the invoicing and payment reminder processes, the software ensures timely billing and follow-ups, leading to quicker payments from customers. This acceleration in the payment cycle enhances the company’s cash flow.

Can Automated Payment Collection Software integrate with existing systems?

Yes, most Automated Payment Collection Software solutions are designed to integrate seamlessly with existing systems such as Enterprise Resource Planning (ERP) and Customer Relationship Management (CRM) platforms, ensuring data consistency and streamlined operations.

Is Automated Payment Collection Software suitable for small businesses?

Absolutely. Automated Payment Collection Software can be tailored to meet the needs of businesses of all sizes. For small businesses, it offers the advantage of reducing manual workload, minimizing errors, and improving cash flow without the need for extensive resources

Conclusion

Automated Payment Collection Software is transforming the way businesses manage their accounts receivable. By automating invoicing, payment processing, and customer communications, companies can enhance efficiency, reduce errors, and improve cash flow. While implementation may present challenges, careful planning and the selection of a suitable solution can lead to significant long-term benefits. Embracing this technology positions businesses to stay competitive in an increasingly digital marketplace.