In the fast-paced world of business, every company—from startups to large enterprises—is looking for ways to streamline operations, reduce costs, and improve accuracy. One of the most vital areas that can benefit from automation is invoicing. Enter Invoice Automation Software, a cutting-edge solution that helps businesses eliminate manual invoicing tasks, reduce human errors, and improve cash flow management.

This article delves deeply into the world of invoice automation, exploring what it is, how it works, its benefits, key features, and how it can drastically improve your business’s efficiency. We’ll also discuss how to choose the best software and highlight a case study of how Emagia leverages AI to offer next-gen invoicing solutions.

What is Invoice Automation Software?

Invoice automation software is a digital tool that automates the creation, processing, and management of invoices. It helps businesses handle invoices from their creation to payment, streamlining workflows, and integrating with existing systems like accounting software and Enterprise Resource Planning (ERP) systems.

This software eliminates the manual task of data entry, approval workflows, and tracking, reducing errors, speeding up the process, and ensuring seamless invoicing that’s both efficient and accurate.

Key functionalities of invoice automation software typically include:

- Invoice Data Capture: Automatically extracting key data (such as invoice number, vendor name, amount, and due date) from invoices using Optical Character Recognition (OCR) or AI.

- Approval Workflows: Managing and routing invoices for approval based on customizable workflows.

- Integration with Accounting Systems: Syncing invoice data with accounting and ERP systems for easier financial reconciliation and reporting.

Why Is Invoice Automation Important?

Time-Saving

Manual invoicing is a time-consuming task that involves entering data, creating templates, sending invoices, and following up on payments. With automation, invoices are generated quickly, sent electronically, and processed with minimal intervention, saving your team hours of manual labor.

Cost Reduction

Automation reduces the need for a large administrative workforce to handle invoicing tasks. The saved costs can then be redirected to other strategic areas of your business, such as marketing, sales, or product development.

Reduced Human Error

Human errors in invoicing—such as incorrect data entry, duplicate invoices, or missed deadlines—are common in manual processes. By using automation, the chances of making these errors are drastically reduced, ensuring that invoices are accurate and timely.

Improved Cash Flow Management

Invoice automation helps businesses track their receivables, send payment reminders, and accelerate the payment process. This improves cash flow management, ensuring that businesses are paid faster and can reduce outstanding accounts receivables.

Enhanced Compliance

Maintaining compliance with tax laws and regulations can be a challenge for many businesses. Invoice automation helps ensure that invoices meet tax and regulatory requirements, as well as providing a comprehensive audit trail for transparency during audits.

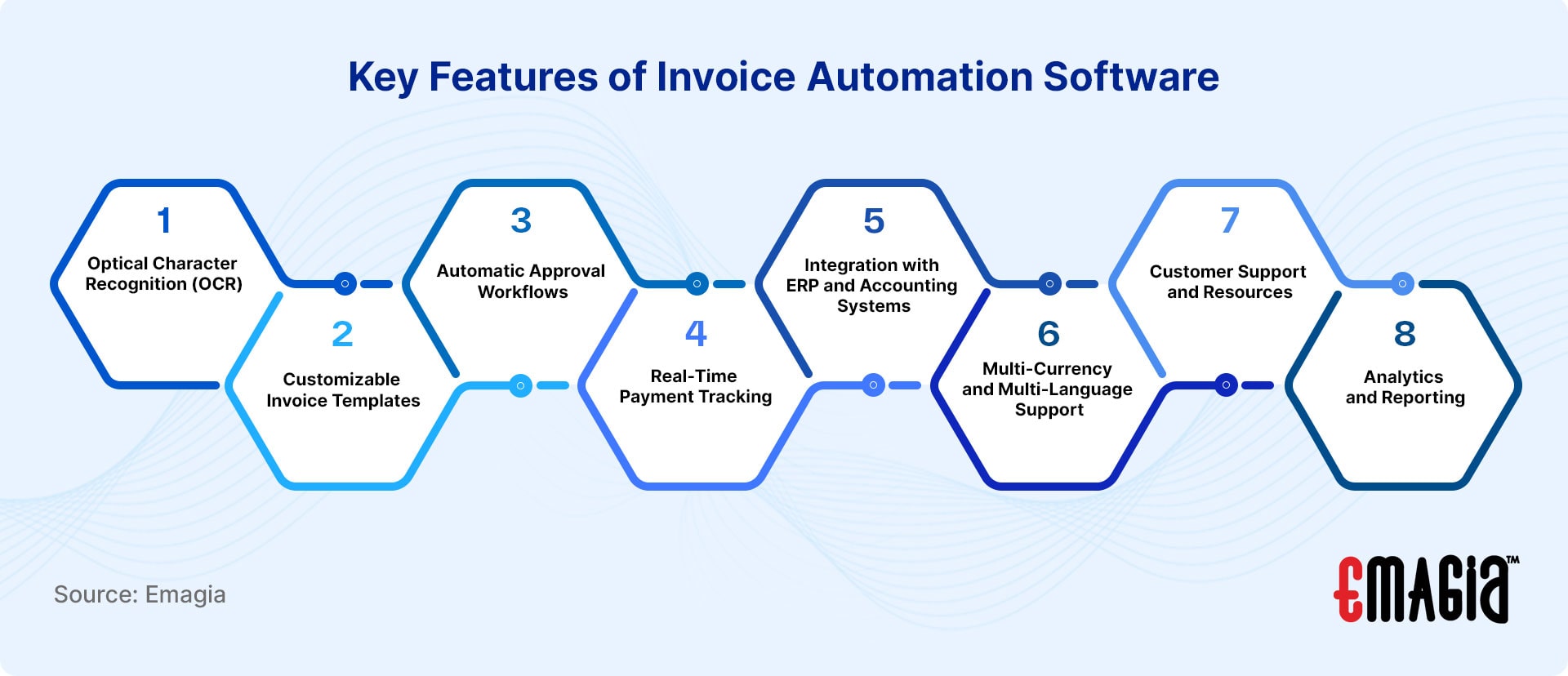

Key Features of Invoice Automation Software

When choosing invoice automation software, it’s important to understand the features that will deliver the most value to your business.

1. Optical Character Recognition (OCR)

OCR technology is one of the most powerful tools in invoice automation. It scans paper-based or PDF invoices and automatically extracts the necessary data. This reduces manual data entry and eliminates common human errors.

2. Customizable Invoice Templates

Invoice automation tools often come with customizable invoice templates. This allows businesses to tailor their invoices with branding, terms and conditions, payment information, and tax details, ensuring consistency and professionalism in all customer interactions.

3. Automatic Approval Workflows

For larger businesses, invoice approvals often require several steps. Automated approval workflows allow invoices to move through the right departments or personnel for quick approval, cutting down on the time spent waiting for authorizations.

4. Real-Time Payment Tracking

One of the most valuable features of invoice automation is the ability to track payments in real-time. This gives businesses a clear overview of their accounts receivable status, allowing them to follow up on overdue invoices and maintain better control of cash flow.

5. Integration with ERP and Accounting Systems

Modern invoice automation software integrates seamlessly with ERP and accounting systems. This ensures that all invoicing data flows into your financial systems, which can be used for reporting, reconciling accounts, and making informed business decisions.

6. Multi-Currency and Multi-Language Support

For businesses operating in multiple countries, invoice automation software offers multi-currency and multi-language support. This feature ensures that invoices can be created and sent to clients in different countries with the correct currency and language settings, improving global operations.

How Invoice Automation Helps Improve Cash Flow Management

Faster Invoice Generation

Invoice automation ensures that invoices are created and sent out promptly, speeding up the billing cycle. The faster your invoices are sent, the faster you can expect to receive payments.

Automated Payment Reminders

Invoice automation tools can automatically send payment reminders to clients when due dates are approaching or when an invoice is overdue. This reduces the need for manual follow-ups and increases the likelihood of timely payments.

Easy Tracking and Reporting

Real-time reporting and tracking features allow businesses to monitor the status of all invoices. From sent invoices to overdue payments, businesses can get a clear snapshot of their accounts receivable, helping them take timely action.

Improved Financial Insights

Invoice automation systems offer detailed analytics, enabling businesses to track trends, monitor cash flow, and make better financial decisions. By analyzing payment patterns and invoice data, businesses can predict future cash flow and plan accordingly.

How Emagia GiaDocs AI Helps with Invoice Automation

Emagia, a leader in AI-powered order-to-cash solutions, takes invoice automation to the next level with its comprehensive platform that optimizes every aspect of the invoicing process.

Emagia’s GiaDocs AI Key Features

- AI-Powered Invoice Data Capture: Emagia uses advanced AI to capture and extract data from both paper and digital invoices, ensuring accuracy and reducing human intervention.

- Seamless Integration with ERP: Emagia integrates effortlessly with your existing ERP and accounting systems, ensuring smooth data flow and accurate financial reporting.

- Intelligent Invoice Approval: The platform automates invoice approvals based on predefined rules, accelerating the invoicing process and reducing approval bottlenecks.

- Real-Time Monitoring: With real-time tracking and alerts, Emagia helps businesses stay on top of overdue payments, improving cash flow and ensuring timely payments.

- Compliance and Audit-Friendly: Emagia’s platform is built to meet global tax and financial compliance standards, providing an audit trail for transparency.

By using GiaDocs AI invoice automation solutions, businesses can optimize their invoicing process, improve efficiency, and reduce errors.

Choosing the Right Invoice Automation Software

When selecting Invoice Automation Software for your business, it’s essential to evaluate various factors to ensure the solution meets your needs and aligns with your business goals. The right software can streamline your invoicing process, reduce errors, save time, and improve cash flow. However, with so many options available, choosing the best one can feel overwhelming. Here’s a breakdown of the most critical factors to consider when choosing the right invoice automation software for your business:

1. Ease of Use

The user experience (UX) is one of the most important factors when selecting invoice automation software. Your team should be able to quickly adapt to the new system without requiring excessive training or support.

- Intuitive Interface: The software should have a clean, user-friendly interface. It should be easy to navigate, even for non-technical users.

- Simple Setup: The onboarding process should be quick and straightforward. Look for software that offers easy-to-follow setup wizards or tutorials.

- Accessibility: Ensure that the software is accessible from various devices (PCs, smartphones, tablets) and can be used by your team both in the office and remotely.

A software that’s easy to use will result in faster adoption and fewer mistakes during invoicing, improving efficiency right from the start.

2. Customization Options

No two businesses have identical invoicing processes. The right invoice automation software should allow customization to fit the unique needs of your company.

- Customizable Templates: Look for software that enables you to customize invoice templates to reflect your brand identity, including logos, colors, and layout.

- Flexible Workflows: Your invoice approval process might require specific routing for different departments or employees. Choose software that supports customizable approval workflows to ensure invoices are reviewed and approved by the right people.

- Payment Terms & Conditions: The software should allow you to set your preferred payment terms, taxes, and other business-specific information on each invoice.

Customizable features ensure that the software adapts to your specific requirements, rather than forcing you to adapt your processes to the tool.

3. Integration Capabilities

One of the most important factors when choosing invoice automation software is how well it integrates with your existing systems. For example, you may already use accounting software, a CRM platform, or an ERP system to manage other business functions. The invoice automation software must work seamlessly with these tools to reduce the need for duplicate data entry and improve efficiency.

- ERP & Accounting System Integration: Choose software that integrates easily with your accounting and ERP systems. Popular tools like QuickBooks, Xero, NetSuite, or SAP are commonly used, so look for software that supports these platforms.

- Payment Gateway Integration: If you use online payment systems like PayPal, Stripe, or ACH for invoicing, your chosen software should integrate with these payment gateways to allow customers to pay directly through the invoice.

- CRM Integration: Integration with Customer Relationship Management (CRM) software helps maintain customer data consistency and ensures that the invoicing process is linked with client history.

By choosing software that integrates with your current systems, you can streamline your processes and avoid siloed data.

4. Scalability

As your business grows, so will your invoicing needs. When evaluating software, consider whether the solution will scale with your business. The right software should be able to handle increased invoice volumes without sacrificing performance or requiring a complex upgrade process.

- Handling High Invoice Volumes: If you’re a rapidly growing business, choose software that can handle a higher volume of invoices without slowing down.

- Additional Features: As your business expands, you may need additional features or more advanced reporting. Look for software that offers various plans or customization options as your business needs change.

- Multi-User Support: Ensure that the software allows multiple users, which is especially important if you have a team handling invoicing, approvals, or payment tracking.

Opting for scalable software ensures that you don’t outgrow the tool as your business expands and avoids the need for frequent software changes.

5. Security and Compliance

Security and compliance are top priorities when handling financial data. Ensure the software you choose adheres to industry standards for data protection and complies with relevant tax regulations.

- Data Encryption: Make sure the software uses advanced encryption methods to protect sensitive data from unauthorized access.

- Compliance with Tax Regulations: Invoice automation software must comply with local tax laws, including VAT, GST, and other regional tax requirements. Look for software that automatically calculates and applies the correct tax rates based on your location and business type.

- Audit Trail and Transparency: Look for software that provides a clear audit trail for each invoice, including who approved it, when, and any changes made. This feature is especially important for businesses undergoing audits.

A secure and compliant solution will protect your data and ensure that your business remains in good standing with local and international regulatory bodies.

6. Cost-Effectiveness

While the features of invoice automation software are important, the pricing model should also align with your budget. Different software solutions have different pricing structures, from subscription-based pricing to per-user or per-invoice models.

- Upfront and Ongoing Costs: Determine the upfront costs (such as licensing fees) and ongoing costs (such as monthly or annual subscriptions). Make sure you know what’s included in the price, and assess whether the software fits within your budget.

- Free Trial or Demo: Many software providers offer free trials or demos, so you can test the software before committing. Take advantage of these offers to evaluate the software’s functionality and usability.

- Cost vs. Value: While you may want to keep costs down, remember that cheap software may not always offer the features, integrations, or support that you need. Balance cost against the features and benefits offered.

Choosing cost-effective software means getting the most value for your investment without compromising on essential features.

7. Customer Support and Resources

Good customer support can be the difference between a smooth implementation and a frustrating experience. When selecting invoice automation software, check the type and quality of support offered.

- Support Channels: Does the provider offer multiple support channels, such as email, phone, chat, or a knowledge base?

- Training and Resources: Look for software that provides tutorials, training sessions, and comprehensive documentation to help your team get the most out of the tool.

- Response Time: Ensure that the support team is responsive and can assist you quickly if you encounter technical issues or have questions about using the software.

Good customer support will help you overcome any issues quickly and ensure a smooth experience as you implement and use the software.

8. Analytics and Reporting

Analytics and reporting are crucial features of invoice automation software. They allow businesses to gain insights into their invoicing process, monitor cash flow, and make data-driven decisions.

- Real-Time Reporting: Choose software that provides real-time reporting on invoice status, outstanding balances, overdue invoices, and payment trends.

- Customizable Dashboards: A customizable dashboard can give you an at-a-glance view of key metrics like outstanding payments, top-paying clients, or payment delays.

- Detailed Analytics: Look for software that offers detailed financial analysis, such as invoice aging reports, payment forecasts, and profitability assessments.

Analytics and reporting tools help you stay on top of your business finances and optimize your invoicing process over time.

FAQs

What is invoice automation software?

Invoice automation software is a digital tool that automates the process of creating, managing, and processing invoices. It reduces manual efforts, enhances accuracy, and streamlines the entire invoicing workflow.

How does invoice automation help with cash flow?

By speeding up invoice generation, sending automated payment reminders, and offering real-time tracking, invoice automation helps businesses receive payments faster and improves cash flow.

Can small businesses benefit from invoice automation?

Yes, even small businesses can benefit from invoice automation. It saves time, reduces errors, and ensures that invoices are sent and processed promptly, helping small businesses maintain healthy cash flow.

How secure is invoice automation software?

Most modern invoice automation tools adhere to strict security standards, using encryption and secure authentication methods to protect sensitive financial data.

Does invoice automation integrate with existing accounting systems?

Yes, most invoice automation software integrates seamlessly with accounting and ERP systems, ensuring smooth data synchronization and reducing manual data entry.

Conclusion

Invoice automation software is not just a luxury; it’s a necessity for businesses looking to optimize their operations, reduce manual errors, and improve financial management. By automating the invoicing process, businesses can save time, reduce costs, and accelerate cash flow, leading to better financial health and more resources for growth.

Whether you’re a small business or a large enterprise, embracing invoice automation can help you stay competitive and agile in today’s fast-moving marketplace. If you’re looking for a comprehensive solution that can take your invoicing process to the next level, Emagia offers an AI-powered platform that automates every aspect of invoicing and ensures seamless integration with your existing systems.

Embrace the future of business efficiency with invoice automation, and start seeing the benefits in no time!