A resource that gives a corporation value is an asset. Liability is what an individual or company owes. In this case, accounts receivable is an asset because it is the money owed to the business from a client. It is a financial asset. After the consumer has paid, it can be transformed into cash. In a business’s accounting ledger, accounts receivable can be turned into cash. Accounts receivable are categorized as current assets because they are to be in cash form within a year. As a result, it is a crucial component of working capital for a business and can be used to finance continuing operations or invest in expansion prospects. This article will cover whether accounts receivable is a liability or an asset.

What are Accounts Receivable?

Accounts receivable is the term used to describe the amount of money owed to a business by its clients for goods or services that have been sold or provided but have not been paid for yet. It is the total credit a corporation has granted to its customers. On a business’s balance sheet, accounts receivable are treated as assets because they are the money the company expects to obtain from their future clients. Businesses can have varied accounts receivable payment terms like 30, 60, and 90 days. This will depend on what type of industry is involved.

Accounts receivable are a crucial aspect of a company’s well-being. Companies keep track of their accounts receivable to make sure that their clients are paying them properly and to see if cash flow is going smoothly.

Why is Accounts Receivable an Asset?

Accounts receivable are seen as an asset because it indicates the sum of money a business is owed by its clients for goods and services that have been supplied or sold. When a company offers it is goods and services on credit, it makes the customer liable for payment at a later time. The business sees this as an asset because it represents an anticipated future cash stream within a year.

How to Increase AR and AP Efficiency with Intelligent Document Processing. Download eBook

What is the Difference Between Assets and Liabilities?

Assets are the resources a company owns and have the potential to produce economic advantages in the future. Liabilities are the commitments or debts a corporation owes to third parties.

| Assets | Liabilities |

|---|---|

| Put money into your company | What your company owes |

| Convert into cash | Risk going bankrupt if you have more liabilities than assets |

| Provide your business with a current or future economic benefit | Decrease your company’s value and equity |

Cash, real estate, investments, and machinery are a few examples of assets. Assets can be defined as current or non-current; this depends on how quickly they can be converted to cash. To account for changes in their market worth, some assets are revalued over time. Depreciation, the distribution of the cost of a non-current asset over its useful life, can also have an impact on asset value.

Bonds, loans, and accounts payable are a few examples of liabilities. Like assets, liabilities can also be defined as current or non-current. However, unlike assets, this will depend on the date on which they are due for payment. If debts are not paid, a business can face legal repercussions. Changes in interest rates can also have an impact on the value of liabilities because they will make borrowing more expensive and boost the liabilities’ worth.

Assets are the resources that a company owns and possible uses in the future. Liabilities are debts a company owes to third parties. They also represent claims against its assets. Typically, assets are the ones that have a more positive effect on the company’s financial position.

Five Ways Businesses Benefit from Accounts Receivable

Businesses can benefit from accounts receivable in various ways:

- Enhance cash flow: By giving customers credit, firms can boost sales and revenue, which improves cash flow. Future cash inflows support operations or invest in expansion prospects and represent by accounts receivable.

- Build customer relationships: Good customer relationships will encourage repeat business and recommendations.

- Minimize bad debt: Companies can reduce the risk of bad debt and write-offs by managing accounts receivable accordingly. Setting credit limits, keeping an eye on payment history, and taking action when payments are late will help with this.

- Obtain financing: Accounts receivables can be used as a security for loans or lines of credit, giving firms access to more money to run their operations or engage in expansion projects.

- Forecasting: Businesses may efficiently plan and budget by using accounts receivable to predict upcoming cash inflows and revenues.

Are Accounts Receivable a Cash Asset or a Current Asset?

Accounts receivable are not cash assets, but they can become cash later. The sum of money owed to a business by its clients for products that have been sold but have not been compensated yet is an account receivable.

Accounts receivable is a current asset because it is anticipated to be paid back within a year. As a result, it is crucial for managing a company’s working capital and cash flow. Being a current asset, it is easy for businesses to evaluate their financial situation.

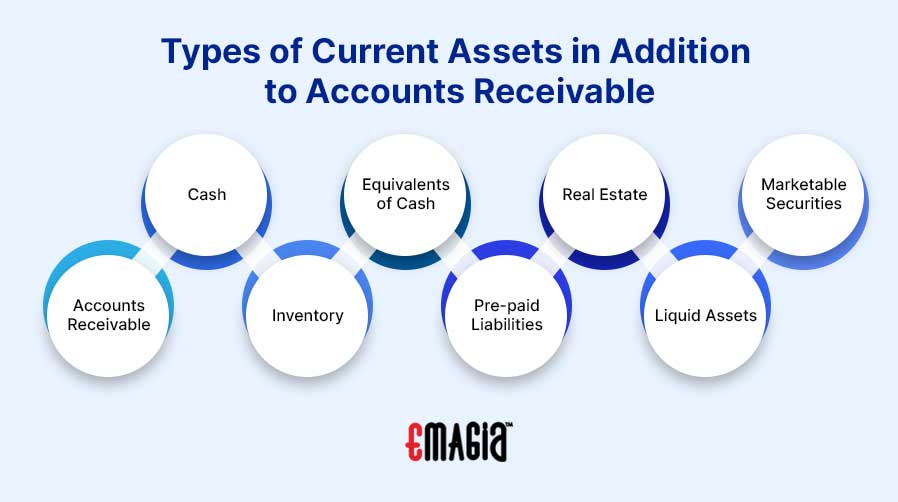

There are other types of current assets in addition to accounts receivable that are shown on the balance sheet including:

- Accounts receivable

- Cash

- Inventory

- Equivalents of cash

- Pre-paid liabilities

- Real estate

- Liquid assets

- Marketable securities

After the receivables are collected, they turn into cash, a liquid asset used to finance ongoing operations, settle debts, or put money toward investment opportunities. When it eventually becomes cash, the business can fulfill some of its obligations like paying bills as well as their employees. Accounts receivable can have an indirect effect on a corporation’s cash position because they have a source of potential future cash inflows.

Do Accounts Receivable Count as a Tangible Asset?

Accounts receivable is a tangible asset. Assets with a value that are simple to calculate are tangible. Some examples include stocks, money, machinery, and buildings. Unexpectedly, accounts receivable are regarded as tangible assets. When a client gets an invoice, the terms of payment and its total are agreed upon. The client is now formally bound to pay this invoice. This makes accounts receivable a tangible asset. Depending on the accounting system, accounts receivable are physical, and current assets are recorded as revenue.

Accelerating AR Automation with Gia Docs AI – Intelligent Document Processing. Request Demo

What are the Different Types of Liabilities?

Liabilities are the money or any other financial obligations a business needs to owe its lenders or suppliers. Here are some common types of liabilities:

- Current liabilities are also known as short-term liabilities. They are responsibilities that have to be settled within a year. It is very important to keep track of your liabilities to ensure that you have the right amount of liquidity from your current assets.

- Long-term liabilities are a corporation’s financial responsibilities that are due after a year. Long-term liabilities can be paid through many business activities, whereas short-term liabilities can be paid just through current assets.

- Accounts payable is the money that you, the client, have to pay to suppliers, for any purchases that have been made. Usually, these should be paid within a month.

- Accrued expenses are expenses that are incurred and have to be taken into account. However, you do not need to pay for these until the next month. They are essentially liabilities that develop over time and need to be paid off.

- Deferred revenues are advanced payments that a business gets for services that are provided later on. Deferred revenue is seen as a liability because it is the money that is promised to clients but has not been received.

- Operating liabilities are the costs that businesses incur to keep their income taxes and accounts payable maintained. The formula to calculate operating expenses is NOA = (total operating assets) – (total operating liabilities).

- Financing liabilities are the money that is used by others and the firm has to pay it back to the lenders.

The Balance Sheet Formula:

Assets + Liabilities = Owners’ Equity

Conclusion:

Accounts receivable is essentially the sum for products a business owes after making a credit purchase. The general ledger account will serve as the place where you record the outstanding sum. In the business’s balance sheet, the account’s outstanding balance is shown. A customer who owes the business money is said to have accounts receivable. Accounts receivable can gauge a company’s liquidity or capacity to meet its immediate obligations. Accounts receivable is an asset because it is the money that a business is owed by its clients. The amount of the account receivable decreases when a client settles their debt, and the money is moved from the asset to a revenue account.

Accounts Receivable FAQs

Are Accounts Receivable an Asset or Revenue?

Accounts receivable is an asset because it is the money owed to a company by a client.

Are Accounts Receivable a Liability or Equity?

Accounts receivable is not a liability or equity because it is money that is owed to a company and appears on the balance sheet.

What are Accounts Receivable Classified?

Accounts receivable are classified as an asset because it adds value to your business.

Is Accounts Receivable a Credit or a Debit?

Accounts receivable is typically listed as an asset, so it is a debit because it is money that needs to be paid to you, so you will be the owner of it.

What are Accounts Receivable on a Balance Sheet?

It is the money a client owes to a company for products that have obtained but have not paid for them yet.

How do you Record Accounts Receivable?

Accounts receivable are recorded in the current asset section of a balance sheet.

Want to learn more about accounts receivable automation software with Emagia? Contact us at info@emagia.com

Lead From The Future. The Future is with AI.