B2B Credit Risk Management Best Practices have changed substantially in 2020. Three disruptive forces, driven by the Covid economy, are converging to seriously impact Credit Risk, revenue, and the financial health of your company.

- Credit Risk has increased tremendously & threatens your firm’s cash flow and profitability. The workload to manage this increased risk will increase by 200 – 400%

- Work from Home can easily reduce productivity, effectiveness and management visibility, just when it’s needed the most

- A shift of sales and order processing activity to E-commerce demands fast, accurate credit approvals for both new & existing customers. Customers will not wait for a slow E-commerce order process.

The key is to review your operations to ensure the fundamental best practices of credit management are being properly used. It is also imperative to automate transactional credit functions to increase the quality, speed, and to cope with the increased workload cost effectively.

The Foundations of Credit Risk Management Best Practices are

- A documented credit policy rooted in an articulated trade credit strategy

- Effective credit vetting to set a credit limit for every customer

- Control of exposure to credit loss through effective collections and by having an automatic order hold function

- Credit insurance and/or other security instruments

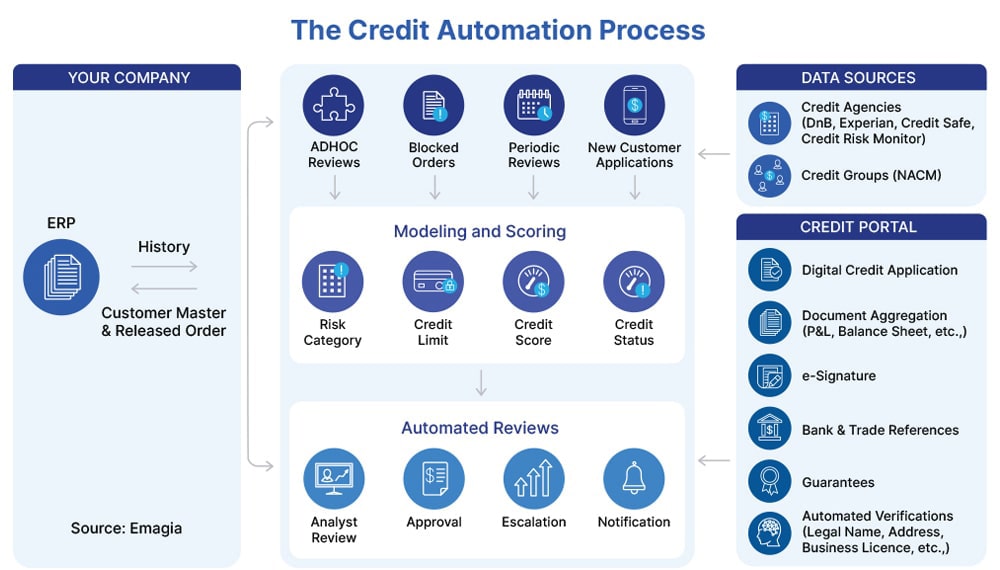

Approximately 70 – 80% of the manual/semi-manual work in credit management can be automated with AI powered digitization.

The Key Operations Credit Risk Management can be Automated are:

- Securing a signed, completed credit application from a prospective customer

- Credit vetting: importing credit data and scoring it

- Setting credit limits based on scores and formulas

- Routing Credit Limit approvals for signature

- Automatically updating credit assessments at designated intervals

- Establishing and enforcing Order Holds

- Creating credit scorecards to track activity, backlogs, etc. within the credit function

- Providing analytics to monitor the overall credit risk in the accounts receivable asset

- Performing “touchless” collection contact on up to 80% of the customer base

- Equipping collectors with auto-prioritization, task Lists, workbench, and document images and dispatch

- Collection dashboards to monitor activity and results

The benefits available include greatly increased productivity, faster response to customers (including E-Commerce orders), increased cash flow and better-controlled Credit Risk.

In today’s economy, AI Powered Digitization is the only way forward for Credit Risk Management.