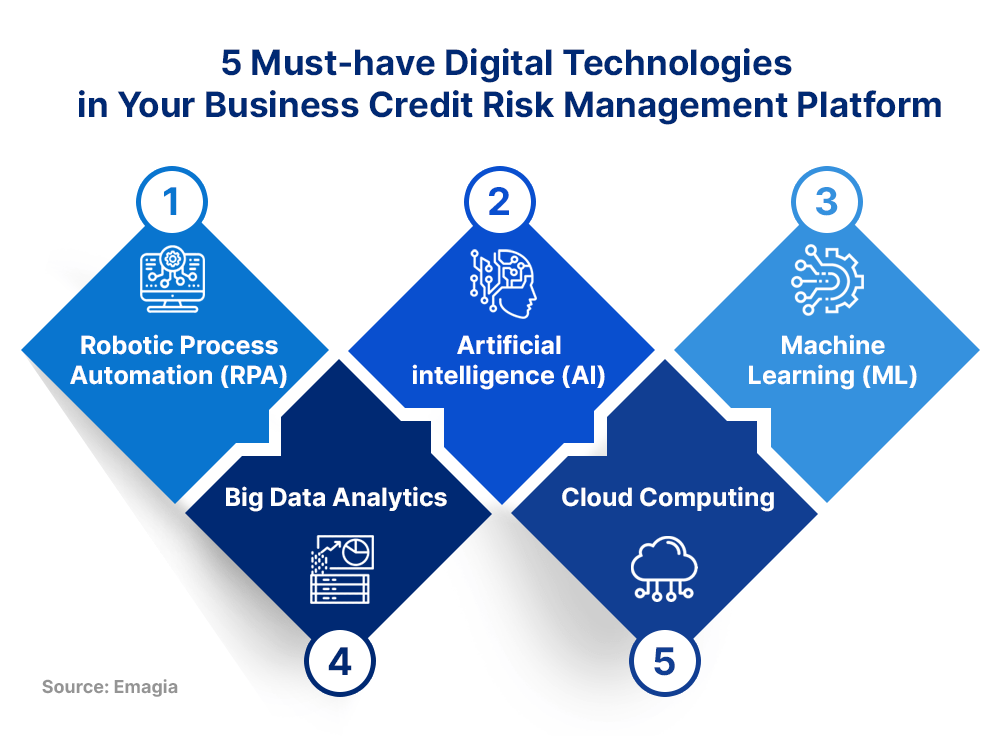

The adoption of innovative digital technologies of late has been making risk control and management better. Enterprises digitally transform their credit risk management processes to manage and navigate volatile market conditions, new regulatory pressures, increasing customer expectations, and other credit risks related to customers and vendors. Lower operational costs, quicker decision-making, and better customer experience are a few of the potential benefits of intelligent credit risk management.

It is to be noted that none of these technologies work in silos, but in combination to manage credit risks. We will examine some technologies that are transforming credit risk management in enterprises to protect these businesses from systemic and unsystematic risks.

The application of RPA to credit risk management has the potential to disrupt enterprises whose business has exposure to credit risk challenges. RPA is now part of the modern credit risk management platform to help enterprises automate many human manual activities, such as entering data, communicating with customers, and collecting relevant data from various sources such as the Office of Foreign Assets Control (OFAC), U.S. Securities and Exchange Commission (SEC), Bankruptcy filings, among other things.

1. Robotic Process Automation (RPA)

The adoption of RPA in credit risk management platforms helps enterprises eliminate errors, enable faster transaction processing, and automate regulatory compliance, resulting in the enhancement of customer experience and cost savings.

2. Artificial intelligence (AI)

Arguably the most critical component in a credit risk management solution, AI helps automate various processes like reading and extracting data from different forms of documents, and analyze the credit scores extracted from other sources, connect multiple data points like the economic history and behavior of customers to provide insight to credit management team for decision-making.

AI, along with ML, helps enterprises to augment the efficiency and productivity of human resources, analyze and enrich unstructured data, identify risky patterns, activities, and behaviors, and reduce workloads involved in the detection of fraud. In other words, AI helps enterprises gather data and information about customers from traditional data sources and external sources and combine them to arrive at accurate insights to facilitate making better credit risk decisions.

3. Machine Learning (ML)

The use of machine learning in credit risk applications helps make credit decisions more accurately and consistently by leveraging AI/ML/NLP to monitor data in real time from traditional sources, social media, online financial news, blogs, and more. The quick and accurate intelligence gained from AI natural language processing (NLP) can lead to giving early signals of potentially damaging events.

Machine Learning (ML) algorithms may help in the evaluation and analysis of data in large sizes from various sources – traditional, social media, government databases, and credit bureaus – for real-time processing based on the customer behavior and history to provide a complete view of customers and their most accurate credit scores.

4. Big Data Analytics

Big data helps derive insight to identify and forecast credit risks that can harm your business. It allows you to store and provide intelligence to mitigate risks by leveraging data and information on customer behavior, interactions with other businesses and financial institutions, and repayment history.

Big Data Analytics helps businesses find out whether any changes occur in the financial condition of the customers after they have been onboarded. In addition to providing a large amount of historical and real-time data, it also analyzes them to provide considerably improved and accurate credit scores. Combining it with predictive analytics can help the platform to minimize uncertain situations and improve informed decision-making.

5. Cloud Computing

The legacy ERP and CRM are not sufficient to provide the credit risk team of enterprises the relevant information in today’s world where technology is used widely across. The cloud environment allows you to access the SaaS model credit risk management solution on an inexpensive Opex mode. It also benefits in the form of the platform getting updated with the changes in technology, and regulatory and economic changes happening in the markets.

In addition, the cloud allows you to store large amounts of data sources from multiple sources and analyze them with various analytical and decision-making tools available in the cloud ecosystem.

Concluding Note on Credit Risk Management

It is critical that the credit risk management solution that you implement in your organization within or along with ERP or OTC system must have all the modern technologies that can take care of the complexities involved in controlling and managing credit risks. Credit risk management, if not managed properly, can create a great amount of pressure on the cash flow and health of your business leading your organization to a bankruptcy filing.