According to The Hackett Group, generative AI has transformative potential in finance. It emphasizes that Generative AI can significantly enhance productivity and reduce operational costs. According to their research, generative AI can increase staff productivity by up to 44% and reduce finance process costs by 42%, offering finance leaders an opportunity to streamline operations and optimize workflows. They suggest that finance leaders should adopt a proactive approach, exploring generative AI to fill gaps and automate manual tasks, which not only drives efficiency but also supports strategic growth.

Generative AI is making waves across many industries and functions including finance. This subset of artificial intelligence goes beyond analyzing data; it generates new content, providing finance leaders with tools to automate tasks, enhance decision-making, and personalize customer experiences.

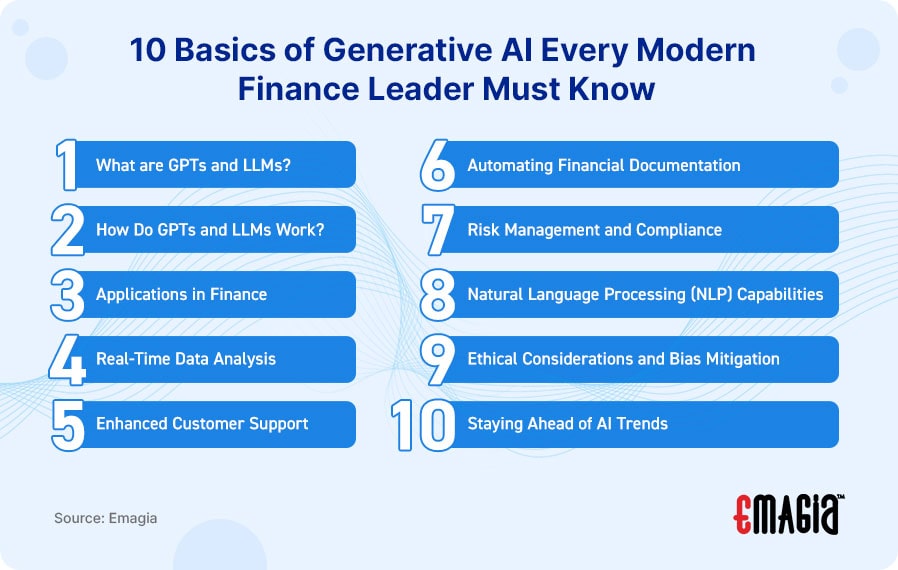

A particularly powerful aspect of generative AI lies in GPTs (Generative Pre-trained Transformers) and LLMs (Large Language Models), which have applications that can transform finance operations. Here’s what finance leaders need to know.

1. What are GPTs and LLMs?

GPTs are a type of large language model that uses deep learning to generate human-like text. These models are pre-trained on vast amounts of data, enabling them to understand context and produce coherent, contextually relevant responses. LLMs like GPT-3 and GPT-4 have billions of parameters, which allow them to handle complex language tasks, from summarizing reports to answering customer queries.

2. How Do GPTs and LLMs Work?

LLMs are built using transformer architectures, which process and generate text by predicting the next word in a sequence. During training, these models learn language patterns and structures, making them capable of generating highly accurate and context-aware content. For finance, this means they can be applied to diverse tasks, such as generating financial reports, interpreting complex data, and creating predictive insights.

3. Applications in Finance

In the finance sector, LLMs can handle a range of tasks that require nuanced language understanding. They can streamline report generation, assist with financial modeling, and automate customer support. By utilizing GPTs, finance leaders can improve efficiency and reduce time spent on repetitive tasks, allowing teams to focus on strategic activities.

4. Real-Time Data Analysis

GPTs and LLMs can analyze vast amounts of real-time data, providing finance leaders with insights into market trends, competitor analysis, and economic forecasts. They can help create dynamic reports that update as new data comes in, allowing for agile decision-making based on the latest information.

5. Enhanced Customer Support

With their natural language capabilities, LLMs can power chatbots and virtual assistants that handle customer inquiries 24/7. They can provide personalized responses, address common queries, and even conduct transactions, significantly improving customer satisfaction while reducing operational costs.

6. Automating Financial Documentation

Generative AI can produce summaries and draft reports based on raw financial data. For example, GPTs can analyze quarterly financial statements and produce summaries for executive teams, streamlining reporting processes. This automation helps finance teams save time and ensures consistency across documents.

7. Risk Management and Compliance

LLMs can analyze unstructured data, such as emails and contracts, to identify potential compliance risks. They can help finance leaders by automatically flagging risky transactions, detecting anomalies, and scanning for regulatory non-compliance, making it easier to uphold standards and mitigate risks.

8. Natural Language Processing (NLP) Capabilities

GPTs excel at NLP tasks, which include understanding and generating human language. This makes them ideal for tasks like sentiment analysis, which can be applied to gauge market sentiment, analyze investor behavior, and assess customer feedback, providing finance leaders with actionable insights.

9. Ethical Considerations and Bias Mitigation

Since GPTs and LLMs learn from vast datasets, they can inherit biases present in that data. Finance leaders should prioritize bias detection and mitigation strategies, such as regular audits and implementing AI governance frameworks, to ensure the AI outputs remain fair and transparent.

10. Staying Ahead of AI Trends

Generative AI is advancing rapidly, with LLMs becoming more sophisticated and capable. Finance leaders should stay informed about the latest developments, such as integrating LLMs with other AI technologies for enhanced analytics, or exploring specialized models designed for specific finance tasks like asset management. Staying ahead will ensure they can adopt the best solutions for their organizations.

Why Embrace GPTs and LLMs in Finance?

GPTs and LLMs offer finance leaders a powerful set of tools to automate processes, generate insights, and enhance customer experiences. By leveraging these technologies, finance leaders can drive efficiency, improve decision-making, and gain a competitive edge.

Generative AI is revolutionizing finance, and understanding the basics of GPTs and LLMs is essential for any leader looking to harness its potential. With a balanced approach to innovation and ethics, finance leaders can unlock new possibilities and drive growth through AI-powered solutions.

GiaGPT is a generative AI solution developed by Emagia specifically for finance operations, especially within order-to-cash processes. As an AI copilot, GiaGPT enabled finance leaders to interact with data, reports, and documents through natural language, facilitating faster and more insightful decision-making. Its capabilities are designed to streamline operations in accounts receivable, accounts payable, and treasury management by providing instant, AI-driven insights and visualizations, such as charts and graphs, which enhance data analysis and interpretation.

GiaGPT is also built with enterprise security in mind, incorporating a trust layer that ensures sensitive data remains secure and compliant with regulatory requirements. This makes it a valuable tool for finance executives seeking to leverage AI without compromising on data privacy. The platform’s interactive data chat feature allows users to engage directly with their ERP systems and documents, transforming the way they access and analyze information.

For more on GiaGPT and its features, you can visit Emagia’s official website or explore further details through their PR.